Table of Contents

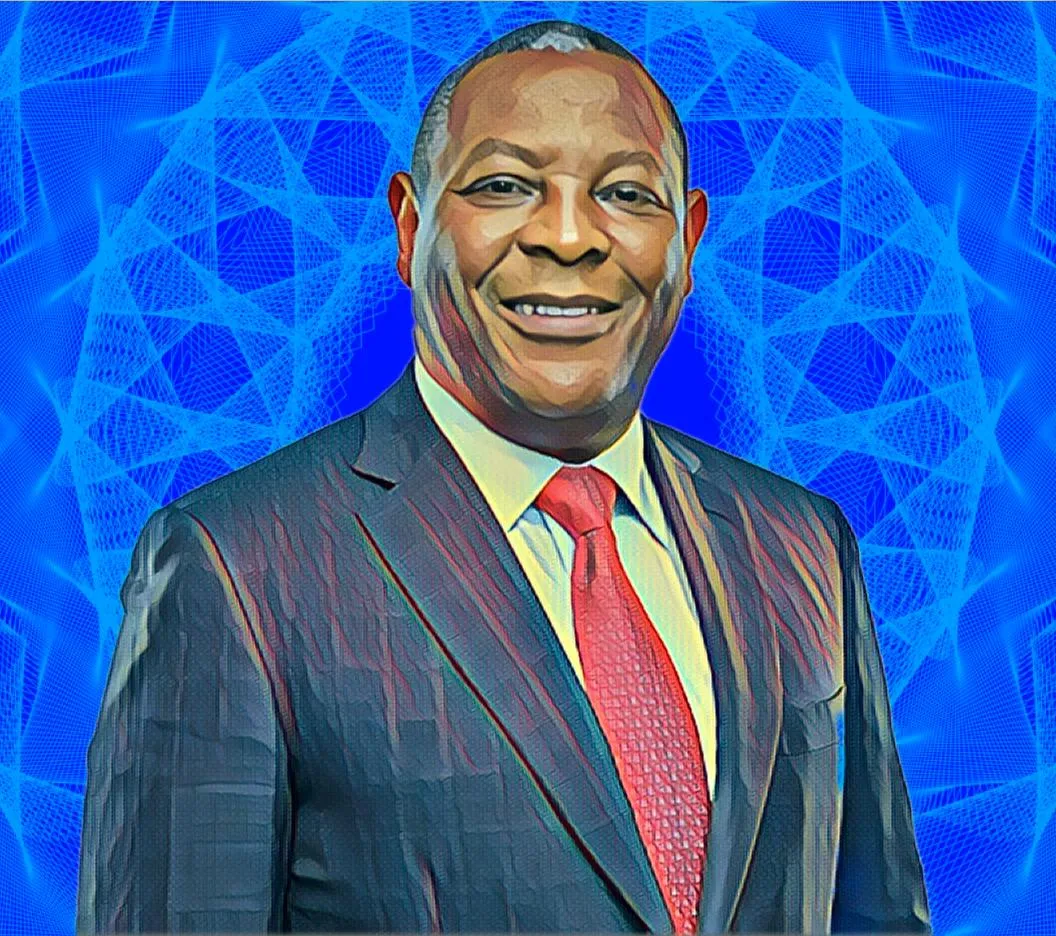

Nairobi-based financial services group, Co-operative Bank Group (Co-op Bank), led by Kenyan banking magnate Gideon Muriuki, is set to embark on a major technological upgrade.

The group plans to migrate its services to a cutting-edge $50-million platform, promising enhanced safety measures and faster transaction speeds for its customers.

Starting on Fri., June 9, and concluding on Mon., June 12, Co-op Bank will transition to its new platform, Finacle, which has been meticulously developed over the past four years.

This shift signifies Co-op Bank’s commitment to improving its banking system, following the announcement made by Managing Director Gideon Muriuki in the group’s annual report.

Gideon Muriuki emphasized the importance of this “new, modern and robust” core banking system upgrade, which aims to propel the bank to the “next growth frontier.”

The new platform, built by Infosys Limited — an Indian multinational IT company — has been designed to provide an enhanced customer experience, reduce downtime incidents, and bolster transaction security.

Co-op Bank announced in a notice that they are delighted to unveil their new and improved banking system, which will enable them to deliver even better customer service.

To facilitate the migration process, Co-op Bank will temporarily close its 184 branches at 3:00 pm on Friday and remain closed throughout Saturday.

However, customers will still have access to essential services, including ATMs, M-Co-op cash mobile banking, Co-op Kwa Jirani agent banking, and credit and debit transactions at various locations where cards are normally used.

As one of the largest financial institutions in East Africa, Co-op Bank boasts an impressive portfolio of subsidiaries, including Kingdom Securities Limited, Co-optrust Investment Services Limited, Co-operative Consultancy & Insurance Agency Limited, Kingdom Bank Limited, and Co-operative Bank of South Sudan.

Under Muriuki, Co-op Bank has achieved remarkable success through its strategic focus on digital transformation and the development of innovative products and services.

The bank’s commitment to delivering value to its customers has been unwavering. In its 2022 fiscal year, Co-op Bank reported a staggering profit rise of more than 33 percent, reaching Ksh22 billion ($169.1 million) from Ksh16.5 billion ($126.8 million) in 2021.

The bank’s upward trajectory continues, with the recently published financial results revealing a profit of Ksh6.11 billion ($44.4 million) for the first quarter of 2023, surpassing the Ksh5.83 billion ($42.4 million) recorded during the same period last year.