Table of Contents

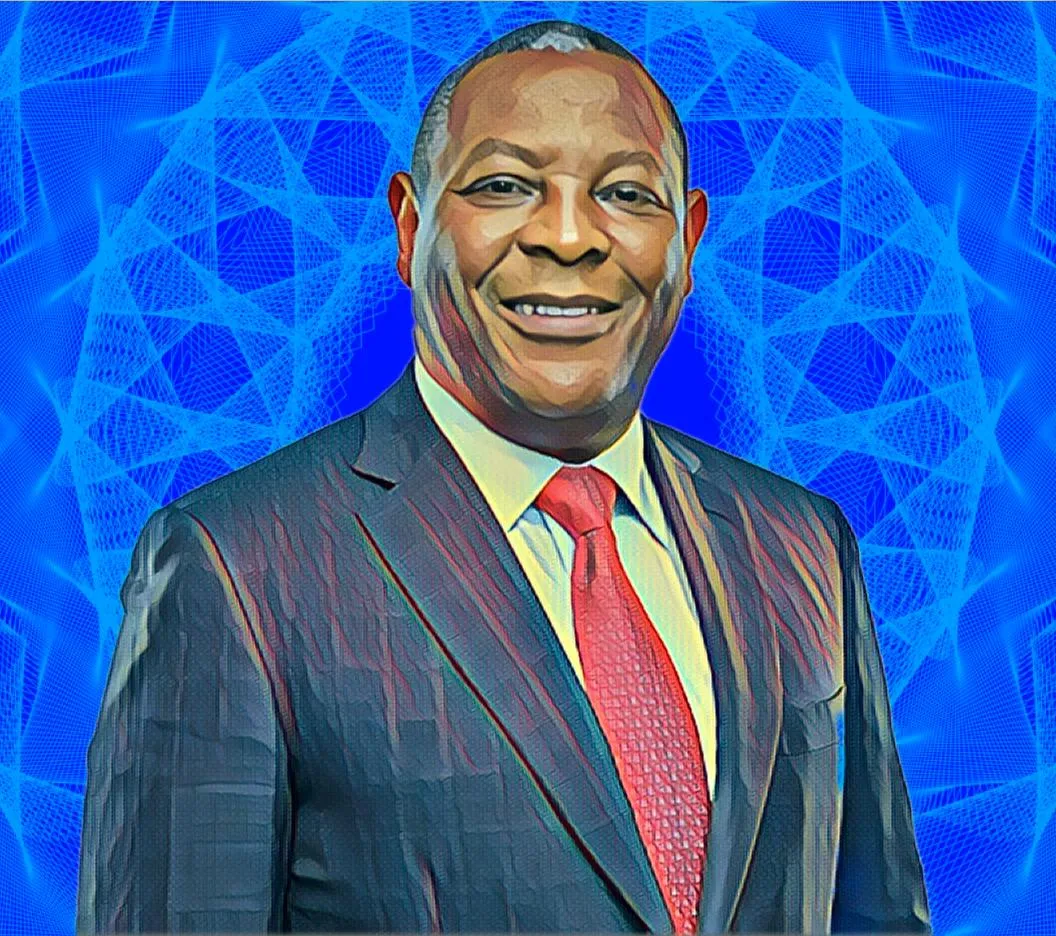

Co-operative Bank of Kenya’s CEO Gideon Muriuki has seen a remarkable 7.9-percent increase in his total remuneration package in 2022, thanks to his outstanding performance at the helm of the organization.

His total compensation amounts to Ksh287.5 million ($2.1 million), which is equivalent to a Ksh21.1 million ($154,120) increase in absolute terms, compared to the Ksh266.4 million ($1.94 million) he received in 2021.

This underscores Muriuki’s remarkable success in leading Co-op Bank to greater profitability, cementing his reputation as a top banking magnate in Kenya and the East African region.

A breakdown of his total remuneration package revealed that his salary increased by 7.6 percent, or Ksh10 million in absolute terms, from Ksh130.7 million ($954,700) to Ksh140.7 million ($1.027 million) during the 2022 fiscal year.

Co-op Bank is one of the largest financial institutions in East Africa, with subsidiaries that include Kingdom Securities Limited, Co-optrust Investment Services Limited, Co-operative Consultancy & Insurance Agency Limited, Kingdom Bank Limited, and Co-operative Bank of South Sudan.

Co-op Bank’s success under Muriuki’s leadership is due to its strategic focus on digital transformation, innovative products, and services, and an unwavering commitment to delivering value to its customers.

Under Muriuki’s leadership, the bank reported an impressive financial performance at the end of its 2022 fiscal year, with profits soaring by more than 33 percent from Ksh16.5 billion ($126.8 million) in 2021 to Ksh22 billion ($169.1 million).

The bank’s robust financial performance underscores its commitment to providing top-notch banking services to its customers and creating sustainable value for its shareholders.

Muriuki commented on the group’s exceptional financial performance, citing the robust income figures as evidence of the group’s exceptional performance and resilience in navigating a complex economic landscape.

He added that the bank’s impressive results are not only sustainable but also indicative of its commitment to delivering value to its shareholders.