Table of Contents

Cactus Cantina Investments Limited, an investment firm linked to Kenyan entrepreneur Peter Njonjo, has received approval from the Central Bank of Kenya to acquire a majority stake in Maisha Microfinance Bank (Maisha MFB), a Nairobi-based microfinance bank licensed on May 21, 2016, to provide microfinance banking services throughout Kenya.

The deal, which involves Cactus Cantina taking a 55.8-percent majority stake in Maisha MFB, was finalized following the fulfillment of all regulatory requirements.

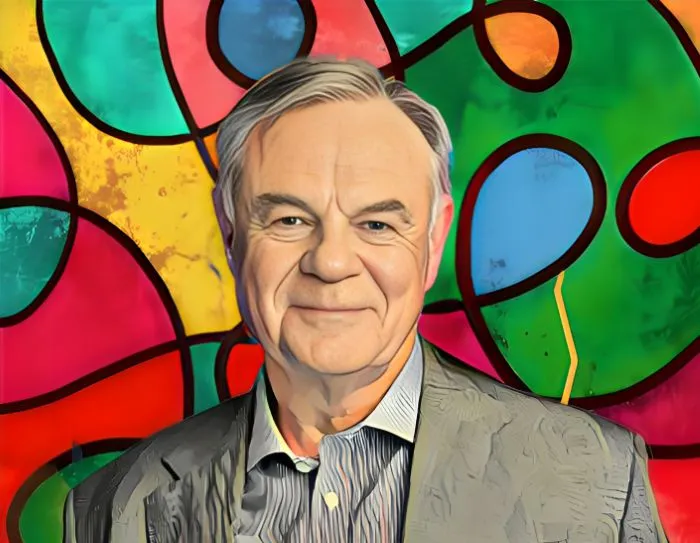

Cactus Cantina, a Kenyan investment entity, is a wholly owned subsidiary of Shara Inc., a U.S.-based firm co-founded by Grant Brooke and Peter Njonjo.

Brooke and Njonjo are also co-founders of Twiga Foods, an agri-tech firm based in Nairobi.

The Central Bank of Kenya has expressed its endorsement of Cactus Cantina’s acquisition of a controlling stake in Maisha Microfinance Bank (Maisha MFB), stating that it will bolster the bank’s position and reinforce the stability of Kenya’s microfinance banking sector.

According to the Kenyan central bank, Cactus Cantina’s investment is set to remodel Maisha MFB’s business model, in line with the CBK’s goal for the microfinance banking industry, and offer the resources needed to support company growth.

Maisha Bank, a medium-sized microfinance bank founded in 2016, controls 1.4 percent of the microfinance banking market, serving a diverse customer base that includes insurance policyholders, insurance agents, micro, small, and medium-sized enterprises, and salaried individuals.

The recent acquisition of Maisha Bank’s controlling stake by an investment vehicle linked to Njonjo and Brooke strengthens their commitment to the Kenyan economy.

The two businessmen have already made significant contributions to the local economy, most notably with the establishment of Twiga Foods in 2013, an agri-tech venture aiming at delivering equitable, dependable, and modern markets to Kenyan farmers and sellers.

In 2021, Twiga Foods secured $50 million from institutional investors in a Series-C fundraising round led by Creadev, a Paris- and Nairobi-based family office, to develop operations in Kenya and adjacent countries.

As part of the effort to put the startup on the path of growth, Twiga Foods’ management team, led by Njonjo and Brooke, has begun a cost-cutting and restructuring operation, which will result in the dismissal of some employees and a reduction in allowances for those who will continue to work for the company.