Table of Contents

CRDB Bank, a leading financial services group linked to Tanzanian billionaire brothers Aunali and Sajjad Rajabali, has received a license to commence operations in the Democratic Republic of the Congo (DRC).

The license was granted by the Banque Centrale du Congo (BCC), following the fulfillment of all regulatory obligations.

The official authorization to operate in the DRC was granted to CRDB Bank during a special meeting between BCC and a delegation from the Tanzanian lender led by its Chief Financial Officer Fredrick Nshekanabo.

This move, which comes a year after the DRC became the seventh member of the East African Community (EAC), is consistent with CRDB Bank’s strategic expansion plan to strengthen its position in the region, consequently increasing earnings and revenue.

Jessica Nyachiro, the newly appointed managing director of CRDB Bank’s DRC subsidiary, stressed that the bank is dedicated to addressing the demands and expectations of the DRC market, as it does in Tanzania and Burundi.

She disclosed that the bank would commence operations with a branch in Lubumbashi and gradually expand its network to other major cities such as Kinshasa, Lualaba, Kasai, Kisangani, Tanganyika, and North and South Kivu within the first three years of operation.

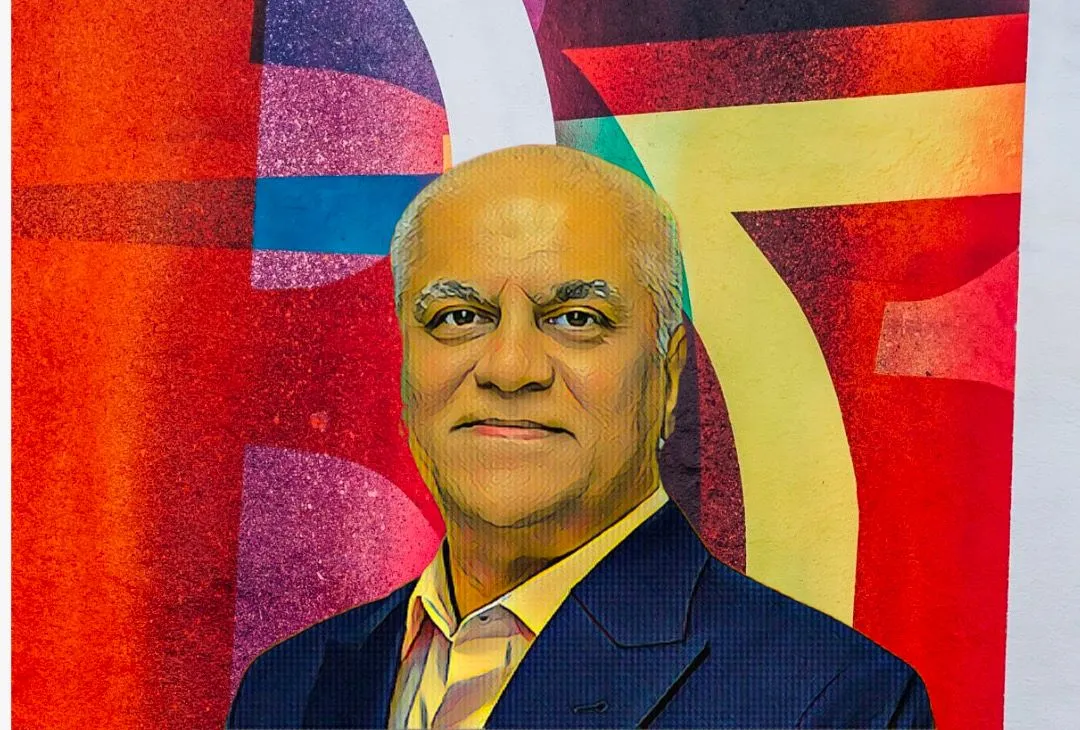

CRDB Bank, which is headquartered in Dar es Salaam and has a significant operational presence in Burundi, is owned in part by the Rajabali brothers. They rank as two of the wealthiest men in Tanzania.

The Tanzanian billionaire brothers own a combined 2.6-percent stake in CRDB Bank, which is worth more than $12.5 million. Their investment in the bank positions them among the leading shareholders on the Dar es Salaam Stock Exchange.

In 2022, CRDB Bank unveiled its plan to penetrate the DRC market with an initial capital of $30 million. As per the agreement, CRDB Bank will maintain a controlling 55-percent stake in the DRC subsidiary.

Under the terms of the deal, the remaining 45 percent stake will be shared between the Norwegian Investment Fund for Developing Countries (Norfund) and the Danish Investment Fund for Developing Countries (IFU), equating to 22.5 percent equity for each party.