Table of Contents

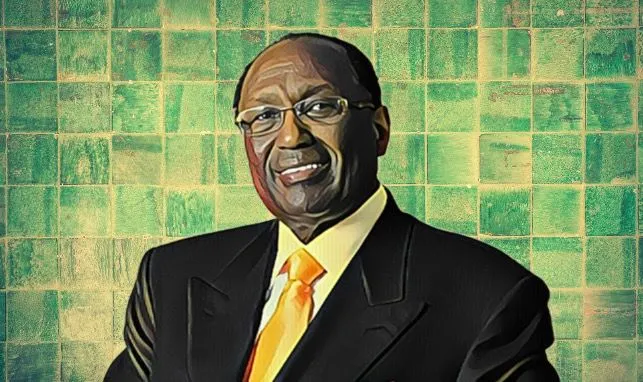

Like Peter Munga, a Kenyan businessman who incurred losses exceeding $1 million from his investment in Britam Holdings, Benson Wairegi has also suffered losses in the millions from his stake in a Nairobi-based financial services conglomerate.

According to data obtained from the Nairobi Securities Exchange, the Kenyan tycoon who ranks among the country’s wealthiest investors has seen his net worth fall by $2.6 million in the last eight months.

The decline in his net worth is the result of sustained selling pressures on the local bourse as well as the depreciation of the Kenyan shilling against the U.S. dollar.

Britam Holdings is a diversified financial services group that operates in several countries, including Kenya, Uganda, Tanzania, Rwanda, South Sudan, Mozambique, and Malawi.

The company’s primary financial services include insurance, asset management, banking, and real estate.

Wairegi, who stepped down from Britam’s board in 2022 after more than four decades with the company, owns a beneficial 4.02-percent stake in the Kenyan investment holding.

Other Kenyan business leaders with significant stakes in the group, in addition to Wairegi, include Jimnah Mbaru, James Mwangi, Peter Munga, and Jane Wanjiru Michuki.

The recent drop in investors’ stake in Britam Holdings can be attributed not only to the depreciation of the Kenyan shilling but also to the decline in the company’s shares on the local bourse.

Britam’s shares have dropped nearly 40 percent in the last eight months, falling from Ksh6.94 ($0.0576) on Sept. 6 to Ksh4.1 ($0.0315), resulting in significant financial losses for the company’s shareholders in the millions of dollars.

Wairegi’s stake in Britam Holdings has decreased by Ksh268.59 million ($2.65 million) in the last eight months as a result of the recent decline in the company’s share price, falling from Ksh703.41 million ($5.84 million) on Sept. 6, 2022, to Ksh434.82 million ($3.2 million) at the time of writing this report.

Skip to content

Skip to content