Table of Contents

Equity Bank, a leading commercial bank in Kenya, has asked the Commercial Court for permission to sell off properties owned by multi-millionaire tycoon Paul Ndung’u over a loan dispute.

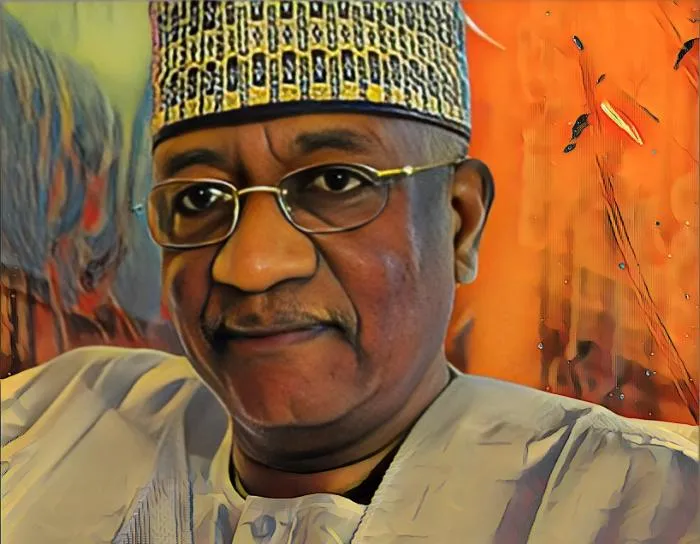

Ndung’u is one of Kenya’s richest men with interests in property and telecom distribution.

He was the former chairman of Sportspesa.

The bank in its opposition to a case filed by Ndung’u, Simba Fresh Produce Limited, Homes and Commercial Holdings Limited argues that despite being in debt has failed to pay back the loan.

Ndung’u owns the majority of Homes and Commercial Holdings, and both he and his family are shareholders in Simba Fresh.

The bank says that even though Simba Fresh was given breaks to help him pay back the loan, he hasn’t kept up with his end of the deal.

Equity claims that Ndung’u knew about the auction because in December of last year, the auction was put on hold because the firms promised to pay back the loan.

“The second plaintiff (Ndung’u) as a charger has always had knowledge of the numerous correspondence exchanged between the plaintiffs and the defendant to restructure the loan. The argument that the second plaintiff (Ndung’u) is not a shareholder or a director of the first plaintiff (Simba Fresh) is not a basis to stop the auction in the circumstances of the present case,” Equity Bank stated.

It also says that Ndung’u owed it Sh 723-million ($5.45-million) as of July 27, 2022, and that interest has kept adding up.

“The plaintiffs have not submitted any reasonable proposal to settle the outstanding debt. The defendant has given extensive concessions to the plaintiffs since the statutory notice of July 27, 2022, but the plaintiffs have not paid the outstanding loan. The allegation that the defendant has blocked or denied the plaintiffs the opportunity to redeem the security is without basis,” Equity’s lawyers Hamilton Harrison and Mathews wrote in court papers.

Equity hired Garam Investments Auctioneers to sell off Gigiri’s best property that belonged to Ndung’u. At the same time, it sought to dispose of three other pieces of land in Solio, Laikipia County which are owned by Homes and Commercial Holdings.

In his case, Paul Ndung’u says that Simba Fresh sends fresh fruits, vegetables, and herbs to the UK. He said that the firm got Sh600 million ($4.5-million) from Equity.

From the loan, he issued a personal guarantee of Sh300 million ($2.26-million) while Homes and Commercial issued a corporate guarantee of the same amount.

The Gigiri property was used to secure Sh300 million ($2.26-million), while the rest of the property was used to secure the rest of the debt.

According to him, after the COVID-19 pandemic, Simba Fresh negotiated a loan moratorium and restructure.

In the case, he argues that the firm court is unable to repay the loan due to the disruptions caused by the pandemic. He says the balance owed to Equity as of March 13, 2023 is Sh664 million ($5-million).

Ndung’u claims that neither he nor Homes and Commercial Holdings were loan guarantors.

“The defendant has never notified the second and third plaintiff (Ndung’u and Homes and Commercial Holdings ) that the first plaintiff was in default and thereby demanded payment of the amount allegedly secured by them under personal guarantee and the corporate guarantee,” Ndung’u claims.

Paul Ndung’u says that by 2021, Simba Fresh had paid more than Sh110 million ($880,000) to pay off the loan. He says that Equity has put his Gigiri home on the market for Sh550 million ($4.14-million), which he says is too low. The three other properties add up to almost 600 acres.