Table of Contents

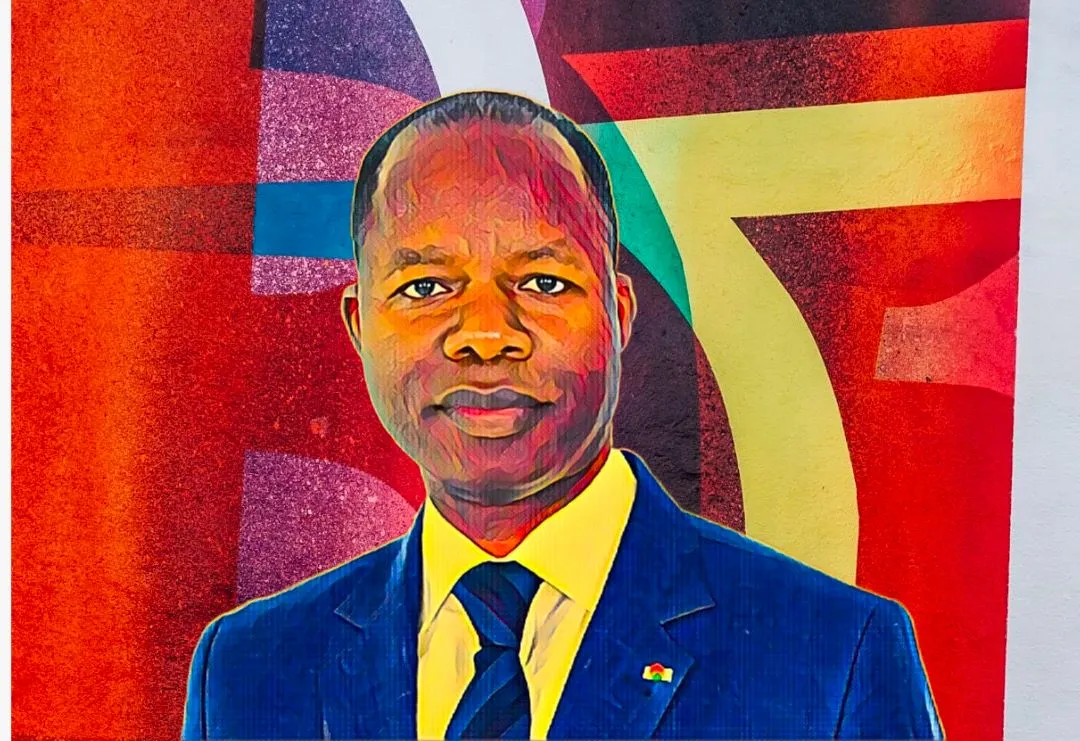

Coris Bank International, the financial services organization based in Burkina Faso and led by esteemed Burkinabe businessman Idrissa Nassa, has seen a notable boost in its share price due to investor reaction to its recent growth strategy.

As a result, the bank’s market capitalization has now exceeded $460 million, with a remarkable increase of CFA23.84 billion ($39.27 million) from Jan. 27 to April 3, elevating its value to CFA283.04 billion ($466.3 million).

Coris Bank International is a prominent player in the West African financial services sector, with a strong presence across francophone Africa, including operations in Burkina Faso, Cote d’Ivoire, Mali, Togo, Senegal, Benin, Niger, and Guinea-Bissau.

The sustained interest from investors has led to a double-digit surge in the bank’s shares on the regional BRVM stock exchange, resulting in a $39.27-million increase in its market capitalization.

In the past 66 days, the bank’s share price has risen by 9.2 percent, from CFA8,100 ($13.34) to CFA8,845 ($14.57), cementing its position as the fifth most valuable company on the regional bourse, according to data tracked by Billionaires.Africa.

Under Idrissa Nassa, Coris Bank’s current deposits exceed $1.4 billion

Under the leadership of Nassa, Coris Bank has become a formidable force in the financial services industry by adopting a unique industrial model tailored to each of its geographic presences. It is presently the second-largest banking group in Burkina Faso, offering retail banking, corporate banking, and Islamic banking services.

As of 2021, the group had a total of CFA859.1 billion ($1.42 billion) in current deposits and CFA1.015 trillion ($1.67 billion) in current loans.

During the first nine months of 2022, Coris Bank’s net income rose from CFA34.74 billion ($57.8 million) to CFA43.18 billion ($71.04 million), owing to a rise in both interest and non-interest income.

This impressive performance highlights the bank’s continued growth and solidifies its position as a key player in the financial services sector.