Table of Contents

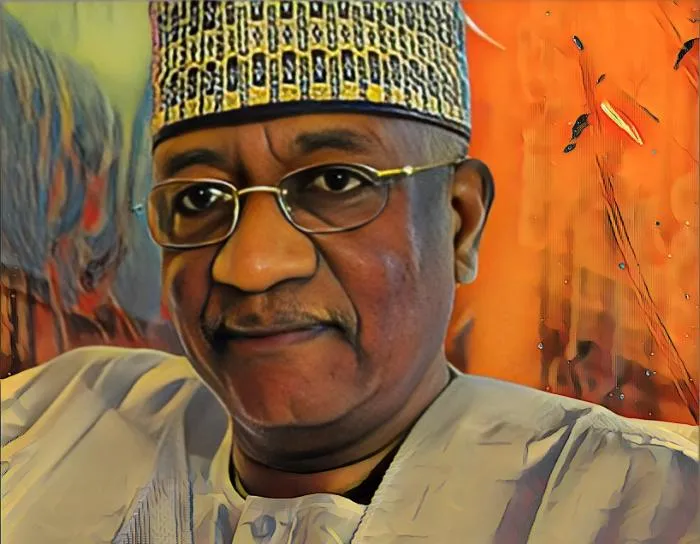

Herbert Wigwe, a Nigerian multimillionaire banker, saw his net worth fall by more than $5.7 million in 2022, as his stake in Access Holdings Plc, a pan-African financial services conglomerate and the holding company of Access Bank, fell by a single digit.

Access Holdings, which is Nigeria’s largest financial services group by assets and one of the most capitalized financial institutions on the Nigerian Exchange, operates in 11 African countries, including South Africa, Ghana, Kenya, Rwanda, and Mozambique.

Wigwe, a leading Nigerian multimillionaire banker and Access Holdings group managing director, played a key role in the group’s growth and expansion. He owns a 4.51-percent stake in the financial services group.

Despite reporting double-digit growth in its earnings in the first nine months of the year, its shares on the Nigerian Exchange decreased by 8.6 percent from N9.3 ($0.0225) on Jan. 3, 2022, to N8.5 ($0.0189) on Dec. 30, 2022.

This led to the market value of Wigwe’s stake dropping from N14.9 billion ($36.06 million) on Jan. 3, 2022, to N13.6 billion ($30.34 million) on Dec. 30, 2022.

This translated to a loss of N1.28 billion ($5.73 million) for the Nigerian multimillionaire banker, who is not only one of the richest investors on the Nigerian Exchange but also one of the wealthiest businessmen in the country.

According to the group’s financial statement for the first nine months of 2022, its profit rose by 12.4 percent during this period, from N122.03 billion ($278.6 million) in 2021 to N137 billion ($312.8 million). Access Holdings’ strong financial performance across its broad-based banking operations can be attributed to this double-digit earnings growth, despite the challenges in its operating environment.

During the same period, the group’s interest income increased by 25.9 percent from N395.14 billion ($902.1 million) to N497.47 billion ($1.13 billion), while its fee and commission income rose from N113.56 billion ($259.2 million) to N133.49 billion ($304.7 million).