Table of Contents

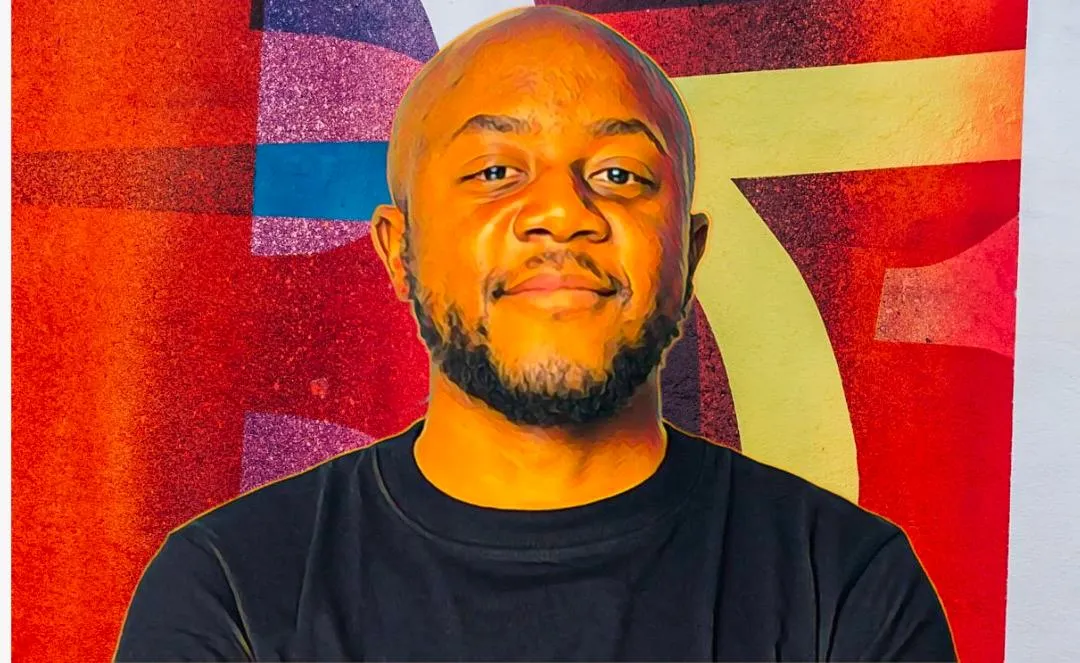

Tantenda Furusa is a Zimbabwean entrepreneur who, with the successful funding of his startup, ImaliPay, has made waves in the African fintech scene this year.

Furusa founded ImaliPay in 2020 in response to the difficulties faced by Nairobi’s gig workers, such as difficulty accessing working capital and dealing with emergencies.

The pan-African fintech startup provides a one-of-a-kind financial services platform that enables gig workers to build a safety net with interest-earning savings, transparent buy now pay later (BNPL) options, and insurance.

The Zimbabwean entrepreneur holds a masters degree in business and management from the University of Nottingham and has a background in fintech.

Prior to founding ImaliPay in September 2020, he worked as a senior manager at Cellulant, a financial technology company that provides payment and financial technology solutions in over 11 African countries.

At Cellulant, Furusa oversaw the company’s global payments’ operation, helping to provide checkout payment and payout options to merchants in Africa.

His goal with ImaliPay is to foster financial security in the gig economy and provide a tailored journey of financial inclusion to the underbanked, and since its founding, the fintech startup has partnered with platforms such as Bolt, Glovo, SWVL, Amitruck, Safeboda, Gokada, and Max.ng to help vendors with their operational needs.

Earlier this year, the fintech startup raised $3 million in debt and equity from venture capital firms such as Ten 13, Uncovered Fund, MyAsia VC, Jedar Capital, Logos Ventures, Plug N Play Ventures, Untapped Global, Latam Ventures, Cliff Angels, Chandaria Capital, and Changecom, as well as angel investors such as Keisuke Honda of KSK Angels.

The $3-million investment will be used to sustain ImaliPay’s growth and expand its offerings to Africa’s underserved gig workers. The funds will also be used to expand the company’s 50-person team, improve technology, and expand into new markets such as Ghana and Egypt.

ImaliPay has experienced tremendous growth thus far, with over 200,000 transactions completed and a 60x increase in the number of users and 4,500 vendor points, and the funding is in addition to the $800,000 in pre-seed funding received the previous year from investors.