Table of Contents

The stake of late Kenyan businessman Chris Kirubi in Centum Investment Plc is now worth $13.5 million, according to information retrieved from the firm’s recently published financial statement and trading data gathered from the Nairobi Securities Exchange,

Centum Investment is the largest publicly traded investment firm in Kenya.

The East African-focused investment firm focuses on real estate and private equity assets in the consumer goods, financial, agribusiness, and power sectors.

The family of late Kenyan businessman Chris Kirubi owns 31 percent of the company, or 205,908,205 ordinary shares.

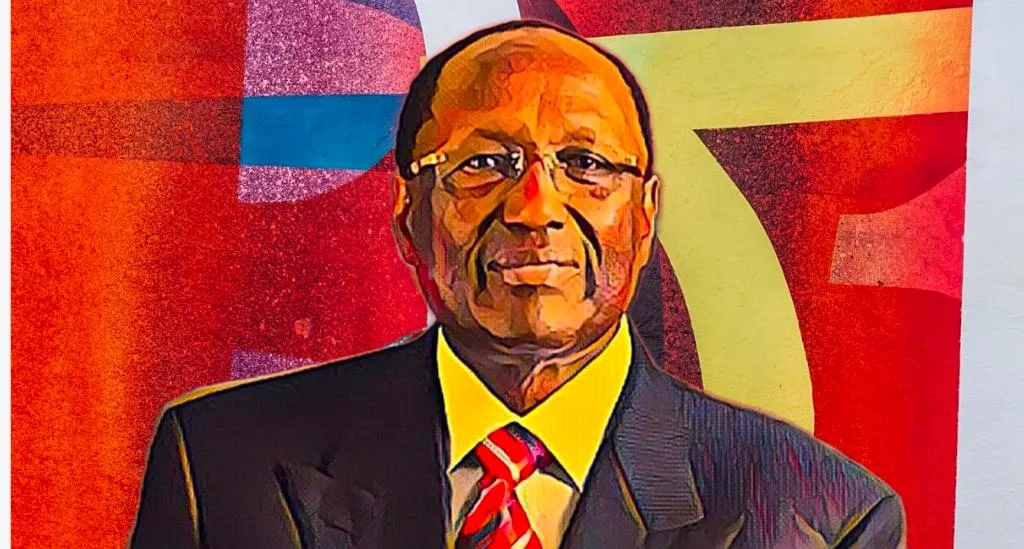

Kirubi, an influential Kenyan businessman and serial investor who died last year at the age of 80, had significant equity stakes in a number of leading companies, including Centum, KCB Group, Haco Industries, and Bendor Estate Limited, all of which form part of his Ksh20 billion ($176 million) estate.

Following his demise, his son Robert Kirubi and daughter Mary-Ann Musangi received 80 percent of his fortune, which included stakes in Centum, KCB Group, Haco Industries, Bendor Estate Limited, and other companies.

At the time of writing, Centum shares were trading at Ksh8.04 ($0.0654) per share, giving the leading investment firm a market capitalization of Ksh5.35 billion ($43.6 million) and ranking it 22nd on the Nairobi Securities Exchange.

At the current price level, the stake held by the family of the late Kenyan businessman is worth Ksh1.66 billion ($13.5 million), making members of the family among the wealthiest investors on the local stock exchange.

Centum Investment has yet to turn a profit since the passing of Chris Kirubi, as the company faces a double whammy of declining income and rising finance costs, despite taking steps to restructure its balance sheets and reduce interest-paying debt in its capital structure.

At the end of the first half of its 2023 fiscal year, Centum saw its net loss increase to Ksh1.55 billion ($12.6 million) from Ksh243.6 million ($2 million) a year earlier, primarily due to unrealized foreign exchange losses.

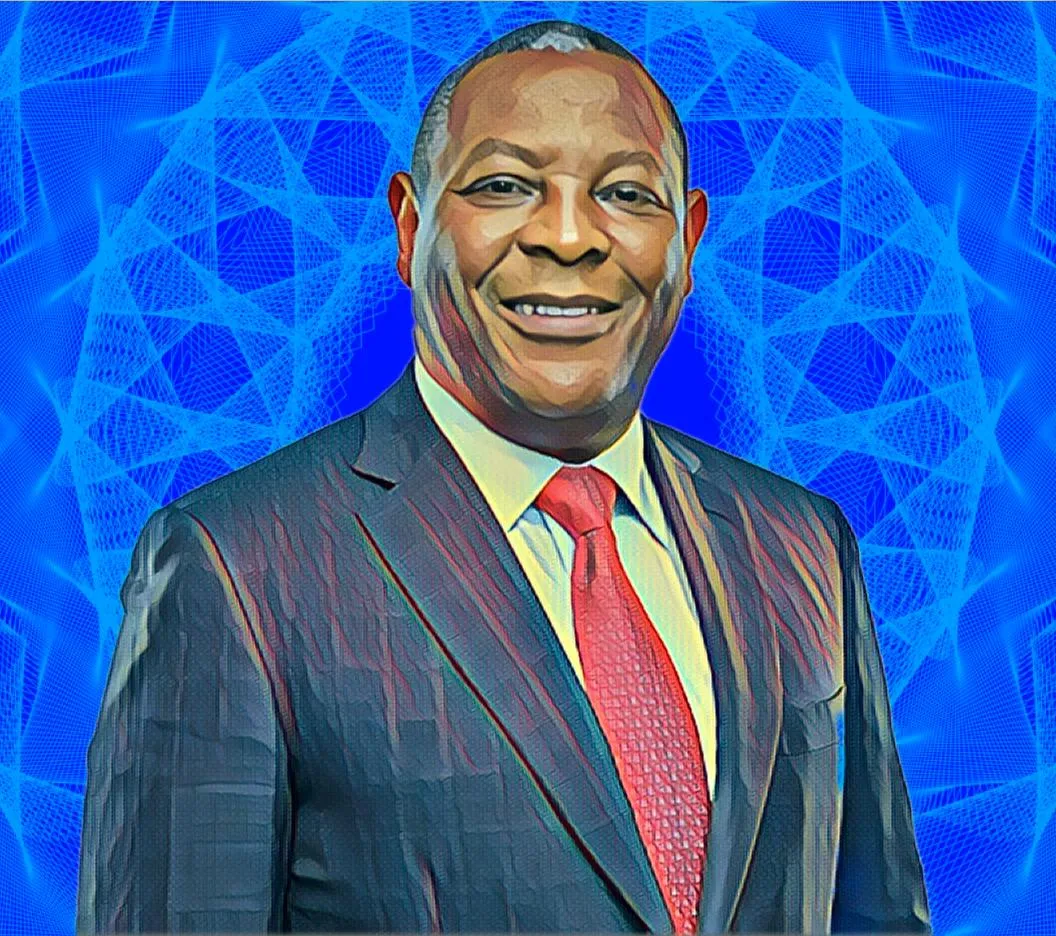

James Mworia, the CEO of Centum, disclosed that the group purchased Ksh1.9 billion ($15.4 million) in Eurobonds as part of the effort to turn around the company’s problems, giving it an average return of nearly 14 percent per year.