Table of Contents

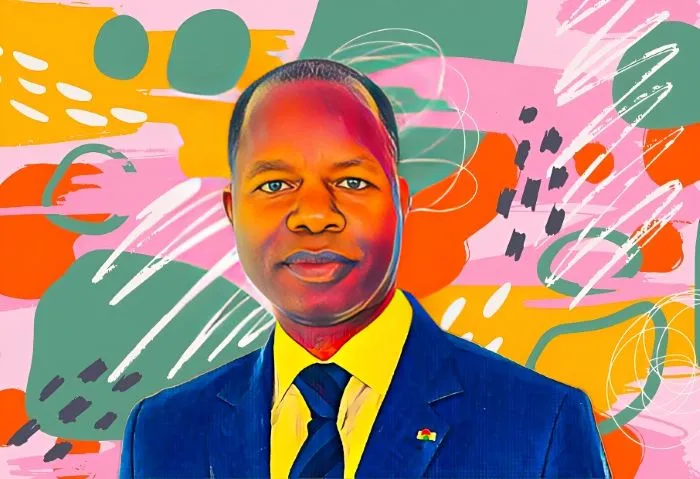

Gerhardus “Gerrie” Fourie, a South African banking executive, has seen the market value of his Capitec Bank shares increase significantly in recent times, as the bank’s shares on the Johannesburg Stock Exchange continue to rise after reaching a record low in September.

According to data tracked by Billionaires.Africa, Fourie’s stake in Capitec Bank has risen by R452.7 million ($26.1 million) in the past 45 days thanks to the recent uptick in the share price of the leading financial services group.

Capitec Bank is a leading South African bank with one of the largest customer bases in the country. It presently operates 856 branches and 7,436 ATMs across South Africa.

At the time of writing, the group’s shares were trading at R2,005.11 ($115.54) a share, up 17 percent from their opening price on the Johannesburg Stock Exchange this morning.

Fourie, Capitec Bank’s CEO for over eight years, owns a beneficial 0.86-percent stake in the Stellenbosch-based banking group. Since joining the largest financial services provider in 2014, he has also received millions of dollars in compensation from the bank for his exceptional work.

The market value of his stake has climbed by R452.7 million ($26.1 million) in the past 45 days, from R1.55 billion ($89.6 million) on Sept. 30 to R2.0 billion ($115.7 million) at the time of writing this report.

The recent increase in the market value of his stake follows a 29.1-percent increase in Capitec shares, as investors on the local bourse continue to scoop up shares in the group after its profits surpassed R4.6 billion ($255 million) in the first half of its 2022 fiscal year, owing to robust growth across its operating segments.

Capitec Bank’s profits after tax climbed by 19 percent in the first half of 2021, according to numbers in the group’s interim financial report, which was announced 45 days ago, going from R3.92 billion ($217.7 million) in the first half of 2021 to R4.67 billion ($259 million).

The banking group’s main operations contributed to the double-digit percent increase in profits, as interest income on loans rose by 13 percent from R6.57 billion ($380.2 million) in the first six months to R7.43 billion ($412 million), driven by a 35-percent increase in loan sales and disbursements from R19.7 billion ($1.1 billion) to R26.5 billion ($1.47 million).

Skip to content

Skip to content