Table of Contents

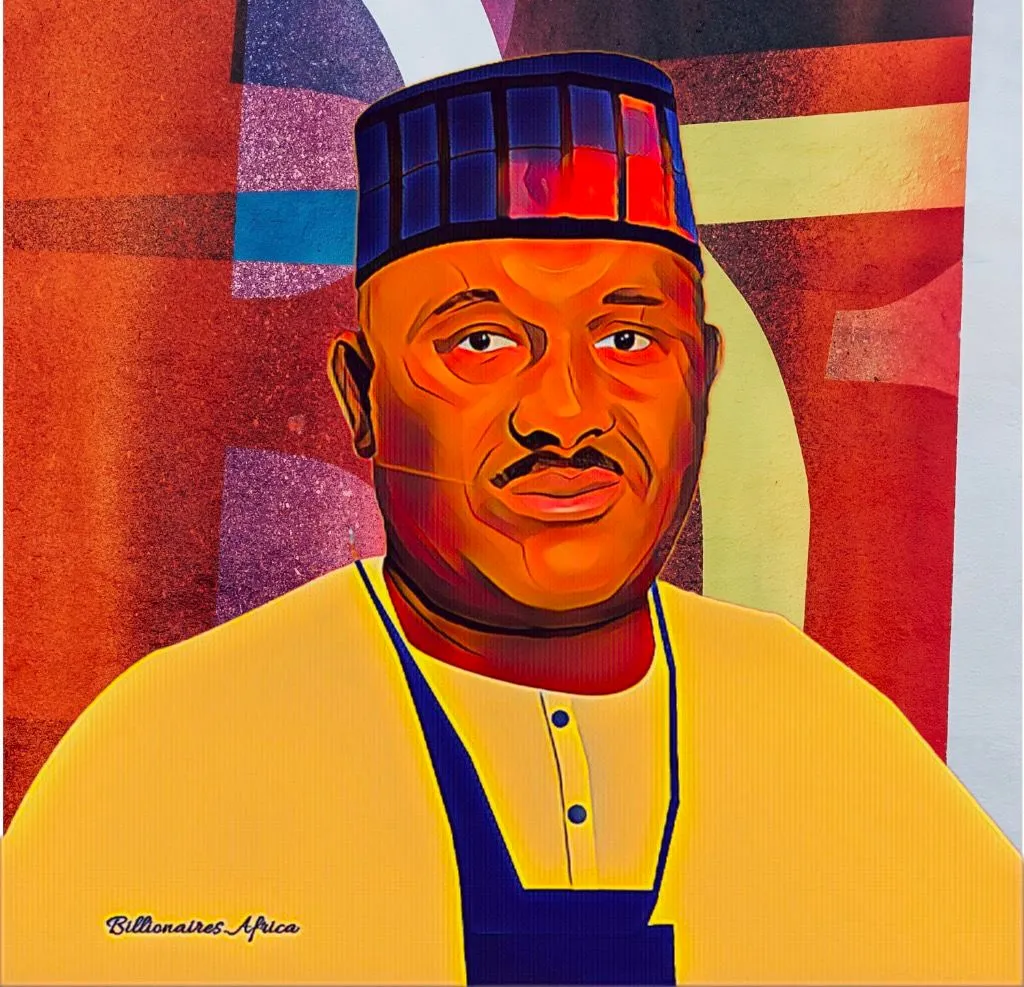

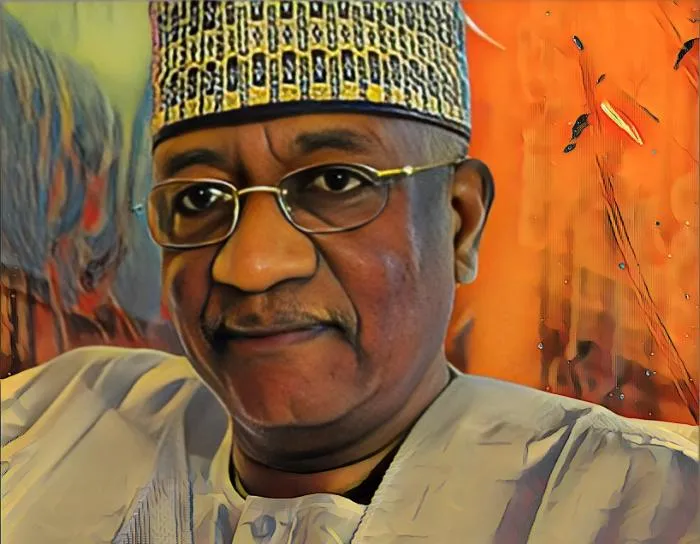

Nigerian billionaire businessman Abdul Samad Rabiu has reclaimed his position as the country’s second-richest man, surpassing telecom and oil magnate Mike Adenuga, whose net worth has declined significantly in recent weeks.

Despite his recent rise, the leading businessman and philanthropist remain far behind Africa’s richest man Aliko Dangote, who leads the list of Nigeria’s wealthiest businessmen, with a net worth of $18.5 billion at the time of writing this report.

Rabiu’s reemergence as the country’s second-richest man comes more than two months after he was toppled by Adenuga, who derives the majority of his fortune from his mobile phone network, Globacom, and his oil exploration company, Conoil Plc.

In recent times, Rabiu’s net worth has risen above $5.6 billion, up from $4.8 billion a month ago, while Adenuga’s net worth has fallen from $6 billion to $5.5 billion due to the revaluation of his privately held investments in Nigeria’s telecom and oil industries.

A report published by Billionaires.Africa five days ago revealed that Rabiu had witnessed a market value increase of nearly $1 billion over the past 27 days thanks to his 92-percent stake in BUA Cement Plc, one of Africa’s fastest-growing cement companies.

The billion-dollar surge in the market value of his stake was spurred by a 27.5-percent increase in the share price of the cement company, which rose from N47.85 ($0.11) per share on Sept. 23 to N61 ($0.14) per share on Oct. 20.

The recent price increases come after the Lagos-based cement maker reported a profit of N61.36 billion ($147.7 million), which is 41.4 percent higher than the N43.4 billion ($104.5 million) it earned at the end of the first half of 2021.

The double-digit increase in earnings was driven by an increase in revenue from N124.27 billion ($299.3 million) to N188.56 billion ($454.1 million) during the review period as a result of pricing benefits, increased production volume, and higher cement demand.