Table of Contents

Moroccan businessman Hassane Amor has now lost millions of dollars from his stake in Microdata this year, as a market-wide sell-off of equities on the Casablanca bourse and the depreciation of the Moroccan dirham against the U.S. dollar depleted the robust valuation of publicly-traded companies, particularly those in the grossly overvalued tech industry.

According to data tracked by Billionaires.Africa, Amor’s stake in Microdata, a Casablanca-based IT services provider, has declined by more than $25 million since the start of the year, as the Moroccan tech company’s valuation remains depressed amid sustained equity sell off among investors as part of the move to preserve wealth.

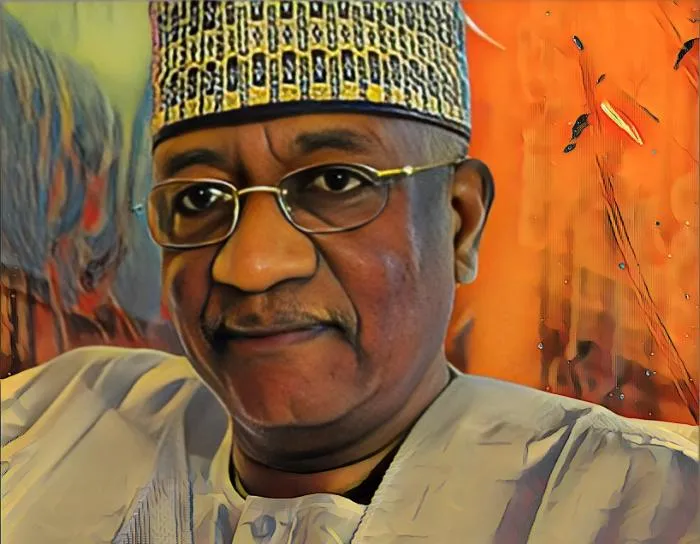

Amor, who started Microdata in 1991 as an IT services provider specializing in cloud, mobile computing, and infrastructure virtualization, has played a crucial role in the growth and expansion of the Moroccan technology sector, particularly through the operation of Microdata.

As the company’s founder and chairman, he owns 56.17 percent of the Casablanca-based IT services business.

At the time of writing, Microdata’s shares were trading at MAD510 ($46.3) per share, giving the leading IT provider a market capitalization of MAD856.8 million ($77.8 million) on the local bourse.

Microdata’s share price has dropped from MAD679 ($73.55) on January 1 to MAD510 ($46.3) on Oct. 13 as a result of recent share sales on the Casablanca market and the Moroccan dirham’s devaluation against the U.S. dollar since the beginning of the year.

The market value of Amor’s stake in Microdata has fallen from MAD640.74 million ($69.41 million) on January 1 to MAD481.26 million ($43.69 million) at the time of writing this report.

Since the year began, the multimillionaire businessman has lost a total of MAD159.48 million ($25.7 million).

Despite the recent decrease in Microdata shares, some experts contend the stock may offer some opportunities for value investors, as the company announced a double-digit gain in earnings at the end of the first six months of 2022.

According to data from its most recent half-year financial report, its profit rose by 15.6 percent from MAD40.5 million ($3.73 million) in the first half of 2021 to MAD46.9 million ($4.32 million) in the first half of 2022.

The robust earnings growth was driven by a 21.4-percent increase in revenue from MAD365.7 million ($33.67 million) to MAD443.9 million ($40.9 million), attributable to a rise in high-value-added projects in the company’s revenue mix.