Table of Contents

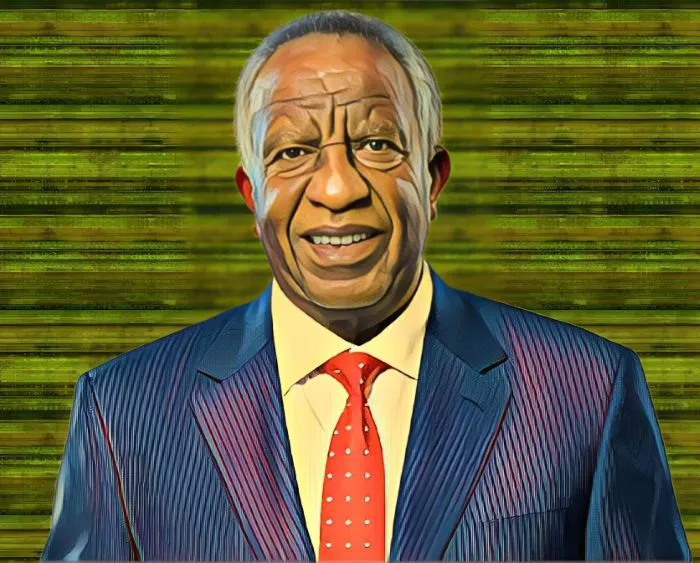

Ghanaian businessman Daniel Ofori has seen the market value of his stake in Ghana’s largest bank, Ghana Commercial Bank (GCB Bank Limited), fall by nearly $10 million since the start of 2022 due to a sustained decline in the bank’s shares and the depreciation of the Ghanaian cedi against the U.S. dollar.

GCB Bank is one of Ghana’s largest banks in terms of total operating assets and industry deposits. According to Tesha Capital, a Ghanaian asset management firm, the bank is the country’s second-largest bank, accounting for more than 11 percent of banking industry deposits.

Ofori, the richest shareholder on the Ghana Stock Exchange, owns 7.49 percent of GCB Bank, making him the third-largest shareholder in the banking group after the Social Security and National Insurance Trust and the Ghanaian government.

According to data tracked by Billionaires.Africa, the market value of Ofori’s stake in the leading banking group has fallen by GH24.8 million ($9.32 million) since the year began.

The decline is attributed to the weakening of the Ghanaian cedi against the U.S. dollar, and a market-wide sell-off of shares on the Ghana Stock Exchange as investors moved to preserve wealth.

Shares in GCB Bank on the local bourse have dropped by more than 23 percent since the beginning of the year, falling from GH5.25 ($0.854) on Jan. 1 to GH4 ($0.384) on Oct. 3.

As a result of price crash, the market value of Ofori’s stake has dropped by GH24.8 million ($9.32 million), from GH104.2 million ($16.95 million) at the start of the year to GH79.39 million ($7.63 million) at the time of writing.

Despite the $9.3-million drop in his wealth, Ofori remains the wealthiest investor on the Ghana Stock Exchange thanks to his well-diversified investment portfolio, which includes stakes in GCB Bank, Societe Generale Ghana, Fan Milk Plc, and CAL Bank.