Table of Contents

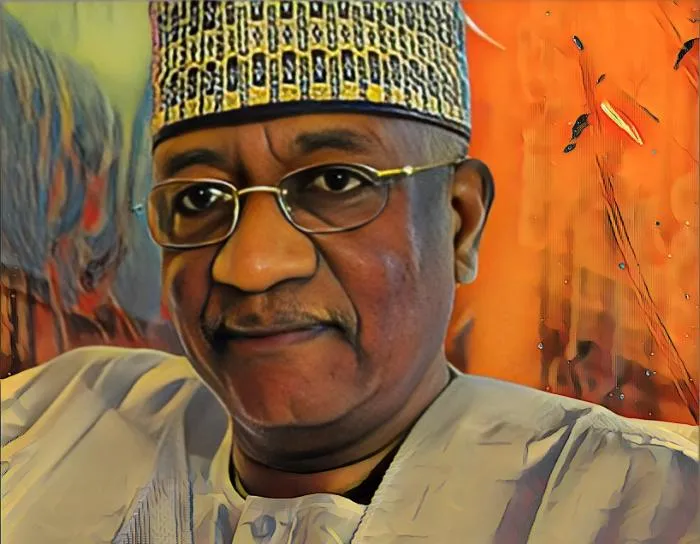

Microdata, a Casablanca-based IT services provider led by Moroccan businessman Hassane Amor, reported a double-digit increase in earnings at the end of the first six months of 2022, with its profit exceeding $4.3 million.

Its profit rose by 15.6 percent from MAD40.5 million ($3.73 million) in the first half of 2021 to MAD46.9 million ($4.32 million), according to data retrieved from the group’s recently published half-year financial report.

The robust earnings growth was driven by a 21.4-percent surge in revenue from MAD365.7 million ($33.67 million) to MAD443.9 million ($40.9 million), owing to an increase in high-value-added projects in its revenue mix.

The IT services provider’s impressive financial performance resulted in a very high valuation, as its shares on the Casablanca bourse increased by nearly six percent as investors reacted quickly to its earnings figures by buying up stakes in the group.

Amor established Microdata in 1991 as an IT services provider that specializes in cloud, mobile computing, and infrastructure virtualization. Amor owns a 56.17-percent stake in the company.

At the time of writing, Microdata’s shares were trading at MAD580.8 ($53.47) per share, giving the leading IT provider a market capitalization of MAD975.74 million ($89.83 million) on the local bourse.

Amor’s 56.17-percent stake in Microdata is now valued at $50.5 million at current market prices.

While commenting on the financial performance, Amor, the chairman and founder of Microdata, said the company achieved a strong financial performance despite the challenging macroeconomic environment.

He added that activity in the first half of 2022 was marked by an increase in gross margins and strong sales performance, which helped to restore Microdata’s commercial activity growth potential.