Table of Contents

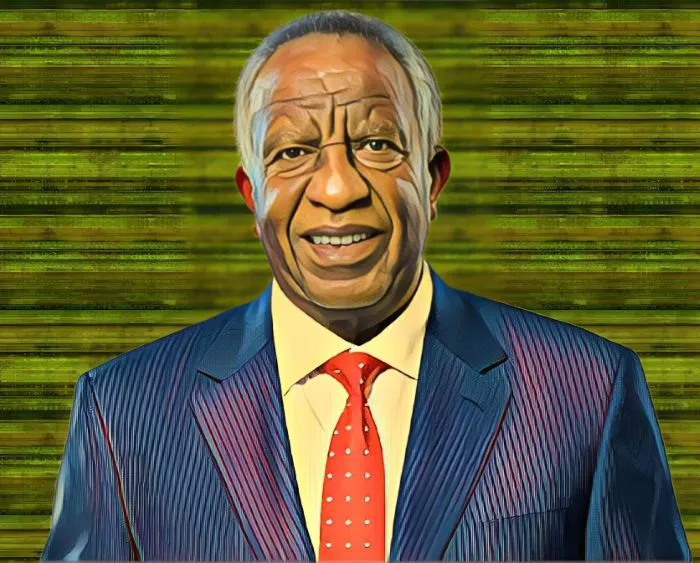

Cipla Quality Chemical Industries Limited (CiplaQCIL), a pharmaceutical manufacturing firm led by Ugandan pharmaceutical tycoon Emmanuel Katongole, is set to pay its first dividends to shareholders four years after going public on the Uganda Stock Exchange.

“Based on our performance, the board has agreed to recommend to shareholders a dividend of Ush2 ($0.00052) per share for approval,” CiplaQCIL Chairman Emmanuel Katongole said. “This is the first dividend payment since the company’s listing. The board is confident that with improved performance, it will be able to maintain dividend payments and provide a return to its shareholders.”

CiplaQCIL reported a profit of Ush24.05 billion ($6.28 million) in its recently published financial statement for the fiscal year ending March 31, 2022, compared to a loss of Ush10.54 billion ($2.9 million) at the end of its 2020-2021 fiscal year.

The increase in earnings was driven by management’s efficient cost-cutting strategies, which resulted in a total of Ush20.2 billion ($5.23 million) in reversed impairment allowance for the Ugandan firm, despite a six-percent drop in revenue from Ush284.54 billion ($74.6 million) to Ush267.43 billion ($70 million).

While commenting on the financial performance, Katongole, who owns 2.79 percent of the company, or 101,933,042 ordinary shares, stated that the group continued to implement its diversification strategy during the period under review, with the aim of increasing sales growth by expanding its product portfolio and tapping into new business opportunities in the private market.

He added that the group’s private market growth strategy resulted in a 100-percent increase in Lumartem sales, its flagship malaria treatment product, as well as the introduction of an antibiotic (Azicip-500), an anti-tuberculosis prophylactic for people living with HIV (Q-TIB), and an analgesic (Cipladon+).

“We are committed to expanding this portfolio further by introducing 20 more products that are currently in the pipeline,” he said, providing more insight into the group’s growth plans.

As a result of the strong financial performance, the group’s total assets increased from Ush226.23 billion ($59.1 million) to Ush244.67 billion ($64.1 million), while retained earnings increased from Ush87.76 billion ($23 million) to Ush104.5 billion ($27.47 million).