Table of Contents

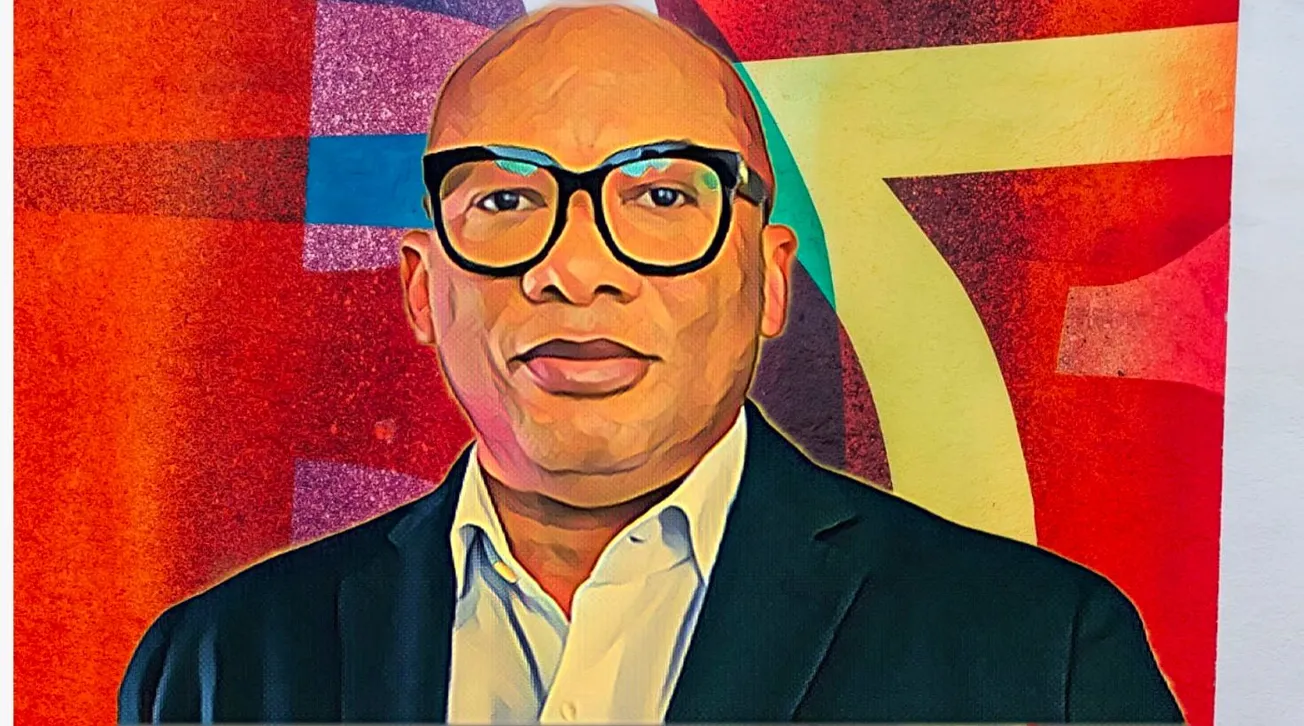

Interswitch, an integrated payment and transaction company led by Nigerian tech tycoon Mitchell Elegbe, has announced that it will begin directly paying allowances to employees’ spouses.

While Interswitch did not specify how much it would pay or the range of pay, it did state that the spouse will be able to make quarterly deductions from the block funds that will be established.

Other benefits include home country mobile status, child educational support, spousal support, enhanced maternity benefits, and step-up capacity, according to the integrated payment and transaction company.

“It has never been lost on us that the satisfaction enjoyed by our customers and partners directly impacts their loyalty to our offerings and their affinity to our business. This satisfaction stems from the value that our satisfied, productive, and loyal employees provide to our customers,” Interswitch said in a statement.

The allowances, which will be deducted from the group’s profit, will invariably have an impact on Interswitch’s revenues and earnings as an enterprise, as it strives to ensure the highest productivity and satisfaction of its most important assets, its employees.

“We have no doubt that when our employees are engaged, productive, and highly satisfied, the brand itself stands a chance of succeeding,” the tech company added.

Elegbe established Interswitch in 2002 as a transaction switching and processing company that operates and maintains a payment ecosystem that allows commerce to evolve, businesses to grow, and individuals to thrive.

Interswitch is now worth more than $1 billion, and it continues to operate as a critical mass player in Africa’s rapidly developing financial ecosystem, offering a full suite of omnichannel payment solutions.

The tech firm received a $110-million joint investment nearly three weeks ago from LeapFrog Investments and Tana Africa Capital, a private equity firm linked to South African billionaire Nicky Oppenheimer.

Its recent investment will be used to scale digital payment services across the continent, as the integrated payment company continues to disrupt Africa’s cash-driven economy with consumer-facing products such as Quickteller, an online consumer services platform for bill payments, and Verve, its pan-African debit card scheme that is presently available in 185 countries.

Apart from being Africa’s second unicorn after Visa acquired a minority 20-percent stake in the company in a $200-million deal in 2019, the digital payment company has evolved to become Nigeria’s first e-payment service that is linked to all the banks in the country.