Table of Contents

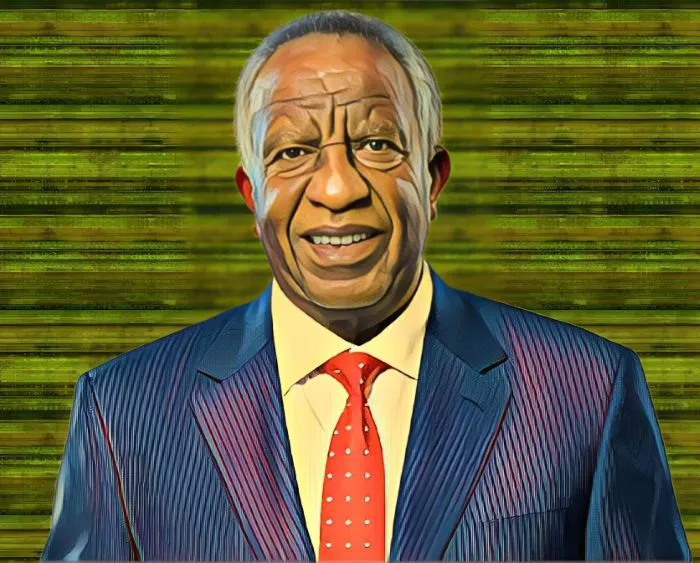

As shares in leading industrial companies continue to rise in value, Egypt’s richest man Nassef Sawiris has surpassed U.S. billionaire Henry Samueli, whose net worth has dropped by $1 billion since the start of the year.

Sawiris’ recent ranking as the world’s 290th wealthiest person represents a significant increase for the leading billionaire, who was previously ranked 372nd in the world after recording significant net-worth gains three weeks ago.

The Egyptian billionaire, who is one of Africa’s wealthiest men, has seen his net worth rise by $738 million since the year began, bringing his fortune above $7.2 billion for the first time since September 2018.

Meanwhile, Samueli, who was significantly wealthier than Sawiris at the start of the year, has seen his net worth drop by $1 billion, from $8.22 billion to $7.22 billion at the time of writing this report, owing to a sell-off in technology companies that impacted the market value of his stake in Avago Technologies.

Despite the impact of the Russia-Ukraine conflict and the resulting economic sanctions on commodities, companies and financial assets on the global equity market, Sawiris’ fortune has risen from $6.5 billion on Jan. 1 to $7.24 billion at the time of writing.

The performance of his stake in industrial assets, OCI N.V., a Geleen, Netherlands-based fertilizer producer formed from a demerger from his family’s original business, Orascom Construction, is to credit for the $738-million wealth increase.

The increase in Sawiris’ stake in the Netherlands-based fertilizer producer was critical in his recovery from a $566-million deficit in the first 73 days of 2022.

The Egyptian billionaire’s 8.8-percent stake in OCI N.V. is presently valued at $2.51 billion, ahead of his stake in Adidas, which is now valued at $2.19 billion. The rotation in his portfolio can be attributed to a 44-percent year-to-date increase in the share price of the Dutch fertilizer company, while Adidas’ shares are down by more than 31 percent.

The recent move comes as no surprise, as shares of fertilizer companies have been in high demand as a result of the commodity boom, particularly since the start of the Russia-Ukraine conflict.

According to reports, the prices of major nutrients have been rising for several months due to supply shortages and high energy prices, resulting in a surge in the share price of fertilizer companies, all of which have increased the output of their urea manufacturing units beyond installed capacity to meet the shortfall caused by sanctions imposed on Russia.