Table of Contents

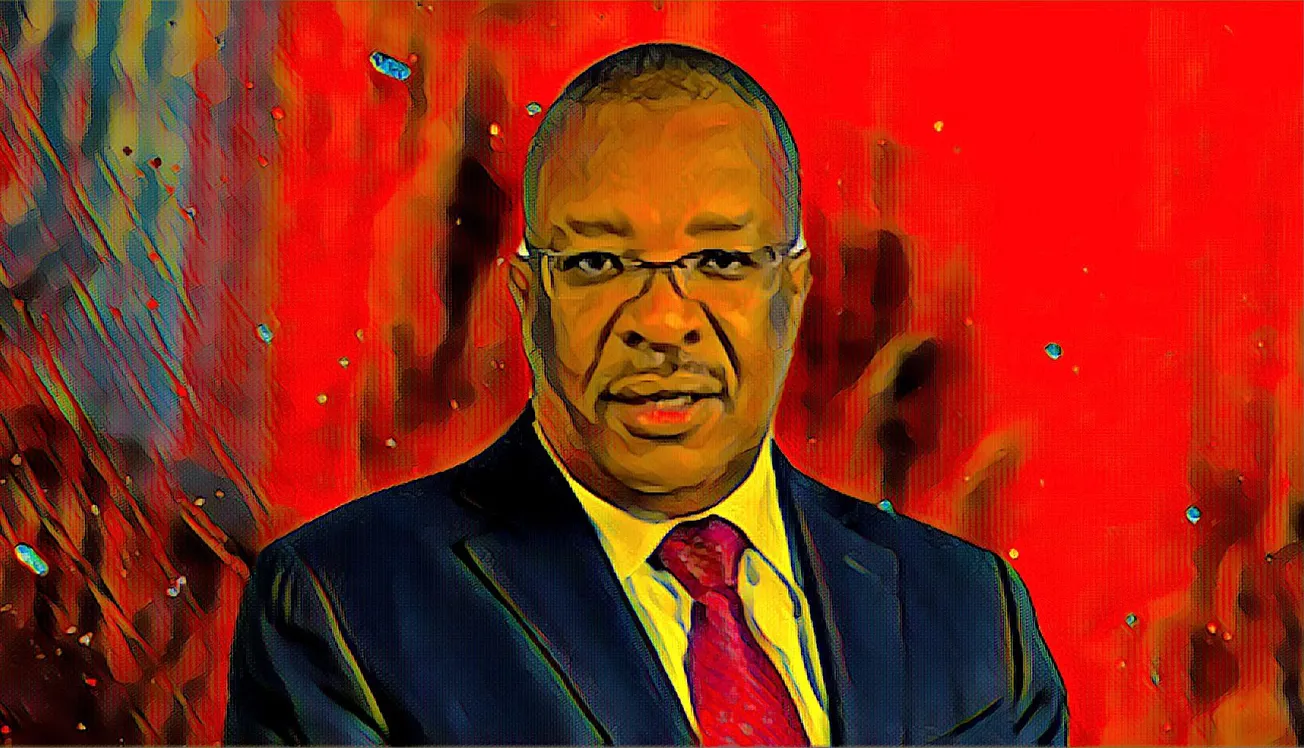

In the year ending December, Co-op Bank CEO Gideon Muriuki purchased an extra 6.1 million shares in CIC Insurance Group, valued at over $100,000.

According to the insurer’s most recent annual report, Muriuki controlled 137.8 million shares, or a 5.3-percent interest, during the period under review.

This was an increase over his previous year’s holdings of 131.7 million shares.

CIC Chairman Nelson Kuria, who formerly served as the company’s CEO, also purchased one million extra shares on the Nairobi Securities Exchange-listed firm. His ownership stayed at 0.6 percent, although his holdings increased to 15.3 million shares from 14.2 million shares.

Patrick Nyaga, CIC’s current CEO, owns 12.1 million shares in the company, or 0.5 percent of the corporation. He bought the majority of the stock shortly after being named CEO in June 2020. Nyaga was previously the director of finance and strategy at Co-op Bank.

Nyaga was chosen to turn around CIC, which was losing money at the time, according to the bank, which owns a 24.8-percent interest in the insurer.

Saccos possess a majority of the bank and the insurer through various investment instruments.

Stakeholders’ stock purchases are interpreted as a vote of confidence in the insurer.

Because they have greater insights into a company’s strategy, growth potential, and competitive position, directors are among a group of insiders whose stock purchases are closely watched by investors.

Directors’ share ownership is also prized since it aligns their interests with those of shareholders, especially if they acquire on the open market with their own money.

CIC made a net profit of Sh668.4 million ($5.78 million) in the year ended December, reversing a loss of Sh296.8 million ($2.56 million) the previous year.

Improved performance across insurance and investment operations, as well as currency moves, supported the company’s return to profitability.