Table of Contents

Sasol, a South African integrated energy and chemicals group led by businessman Fleetwood Grobler, has announced that it will no longer source gas from the African Renaissance Pipeline (ARP), a planned pipeline stretching from northern Mozambique fields to South Africa.

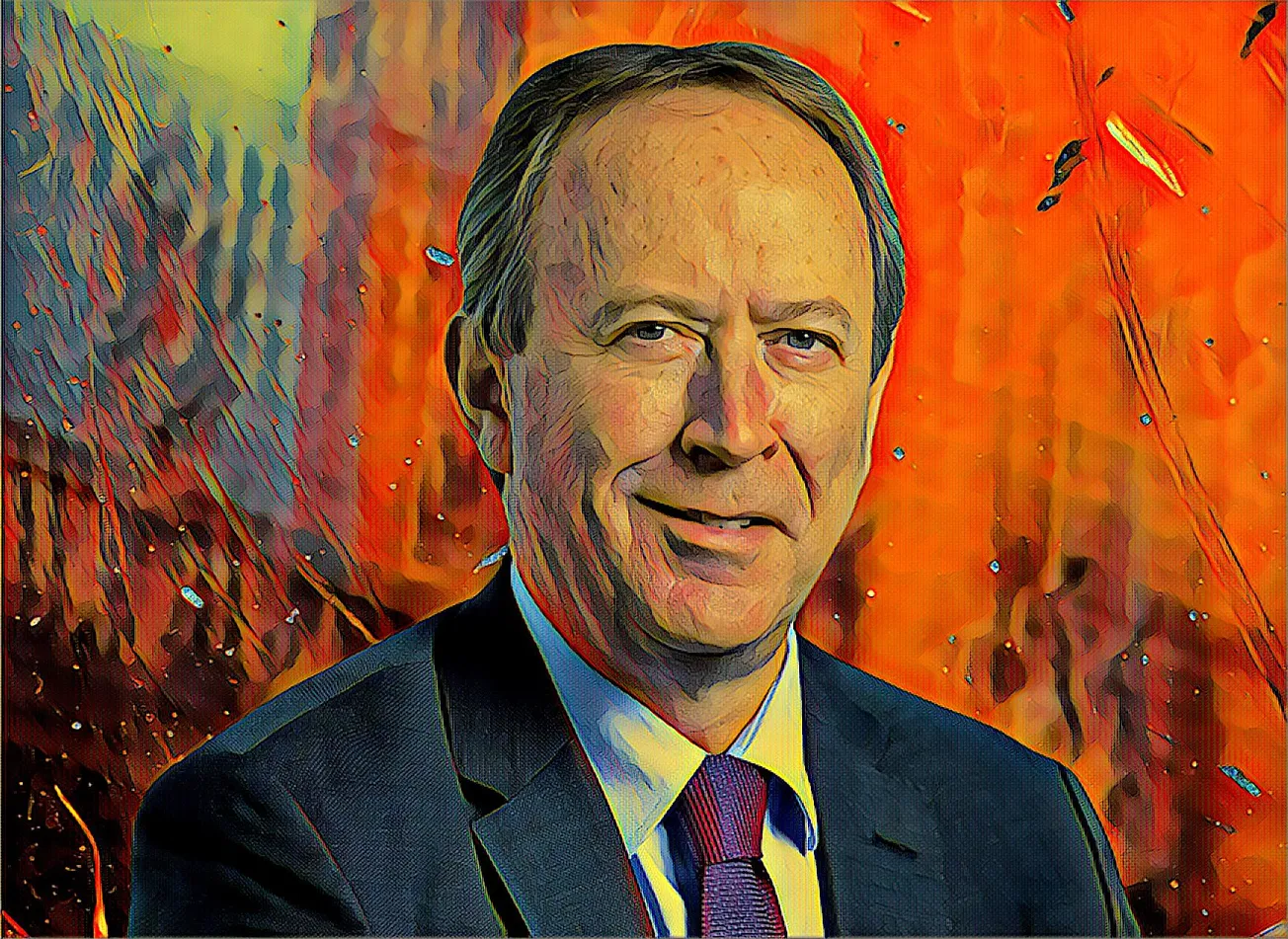

Grobler, Sasol’s CEO, announced the move, which is in line with the company’s plans to diversify its asset base and reduce emissions by 30 percent by 2030 as the world shifts away from fossil fuels.

Grobler stated in his statement that if the company purchases shares in the project as initially announced, it will be tied to it for 30 or 40 years due to the nature of the investment.

“It’s a no-regrets move because you know it will deplete, and then you don’t develop more gas when you don’t need it.” Long-term, gas is a fossil fuel, and we said we wanted to get to net-zero carbon emissions, which would be a pain in our throats as the world transitions away from fossil fuels,” he said.

This comes nearly two years after Sasol announced its intention to acquire stakes in the proposed 2,600-kilometer (1,616-mile) ARP – a $6-billion pipeline infrastructure that connects northern Mozambique reserves to two provinces in South Africa.

Sasol is an integrated energy and chemicals group headquartered in Sandton, South Africa’s affluent Gauteng Province. It is a major producer of liquid fuels, chemicals, and electricity, as well as a well-known developer of technologies such as synthetic fuels.

Under the leadership of Grobler, president and CEO of Sasol, the South African energy and chemical group operates in 33 countries and employs 30,100 people globally.

As of press time on April 15, Sasol shares were worth R368.70 ($25.18) per share, giving the diversified energy group an R234-billion ($16-billion) valuation on the Johannesburg Stock Exchange.

Grobler’s stake in the group is valued at R10.1 million ($690,000) at the current market value.