Table of Contents

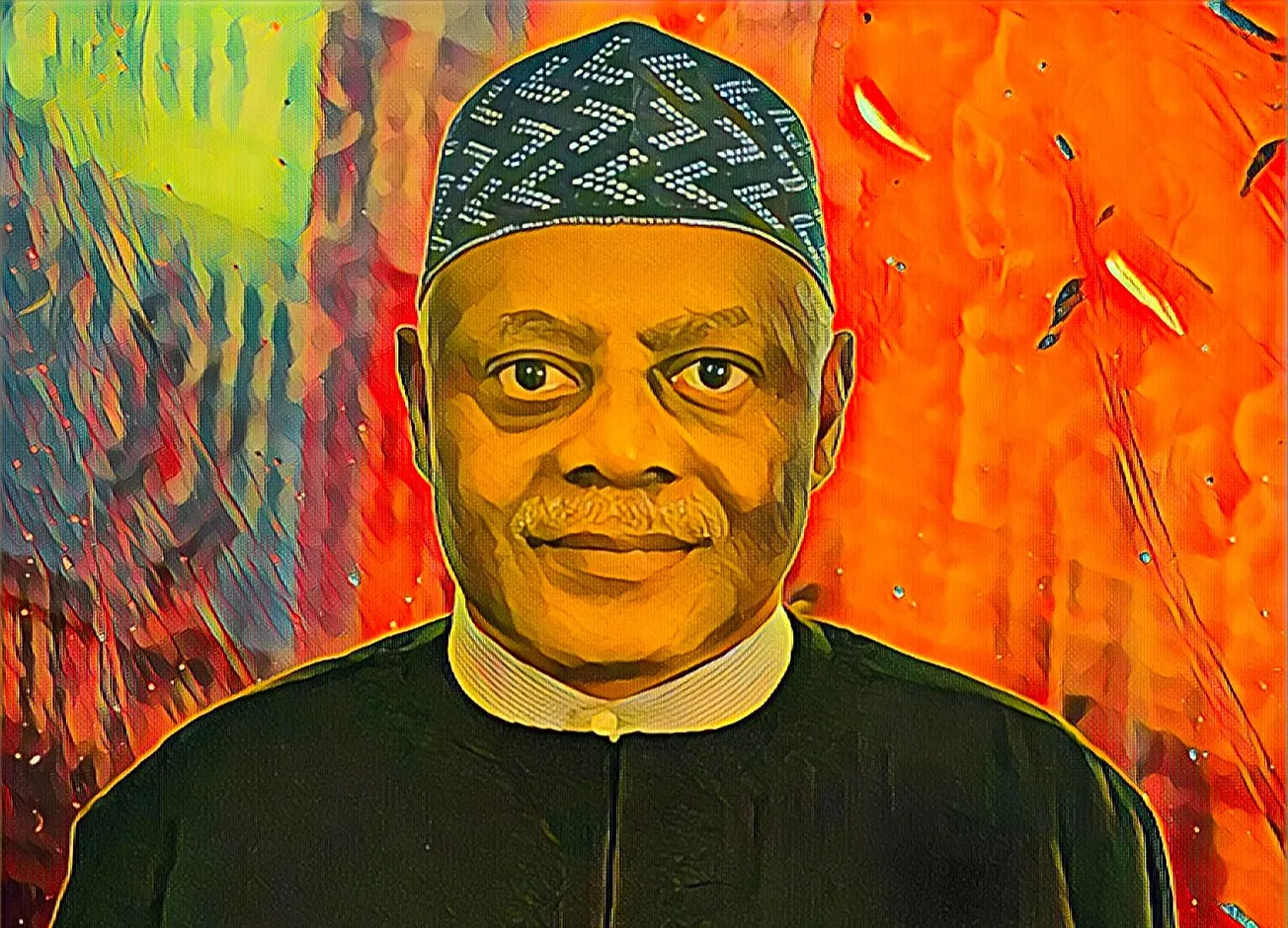

One of Nigeria’s foremost telecom investors Bashir Ahmad El-Rufai owns a beneficial stake in IHS Towers, one of Africa’s largest telecom infrastructure providers, worth more than $11 million.

IHS is one of the world’s largest independent owners, operators and developers of shared telecom infrastructure, with a total of 30,519 towers in its portfolio spread across three regions and nine countries.

El-Rufai, who co-founded Nigeria’s first indigenous private telecom operator, Intercellular Nigeria Limited, owns a beneficial 0.32-percent stake in the leading telecom infrastructure, totaling 1,056,682 shares.

The businessman played a key role deregulation of the country’s telecom industry in the early 2000s. He has been a director and chairman of the board of directors for IHS Nigeria since 2002.

In addition to his responsibilities at IHS Nigeria, El-Rufai served as chairman of the board of directors of IHS Towers from 2013 to 2019.

As of press time on March 24, IHS Holding shares were worth $10.38 per share, giving the company a market capitalization of $3.4 billion on the New York Stock Exchange. The market value of El-Rufai’s stake is $11 million at the time of writing.

Since the start of the year, the market value of his stake has fallen by $3.5 million from $14.54 million on January 1 to $11 million as of the time of drafting this report.

The year-to-date decline in the market value of his stake can be attributed to investors’ reaction to the figures in the IHS Towers financial report, which revealed a loss of $26.1 million at the end of its fiscal year 2021, which ended on Dec. 31.

Despite a double-digit increase in sales, the group’s cumulative losses increased from $2.84 billion to $2.86 billion as a result of the poor performance, while its declared capital increased from $4.53 billion to $5.22 billion as a result of its IPO debut on the New York Stock Exchange in 2021.

The poor performance in 2021 prompted investors to sell down their stakes in the group in an attempt to reduce exposure to the tower infrastructure company.