Table of Contents

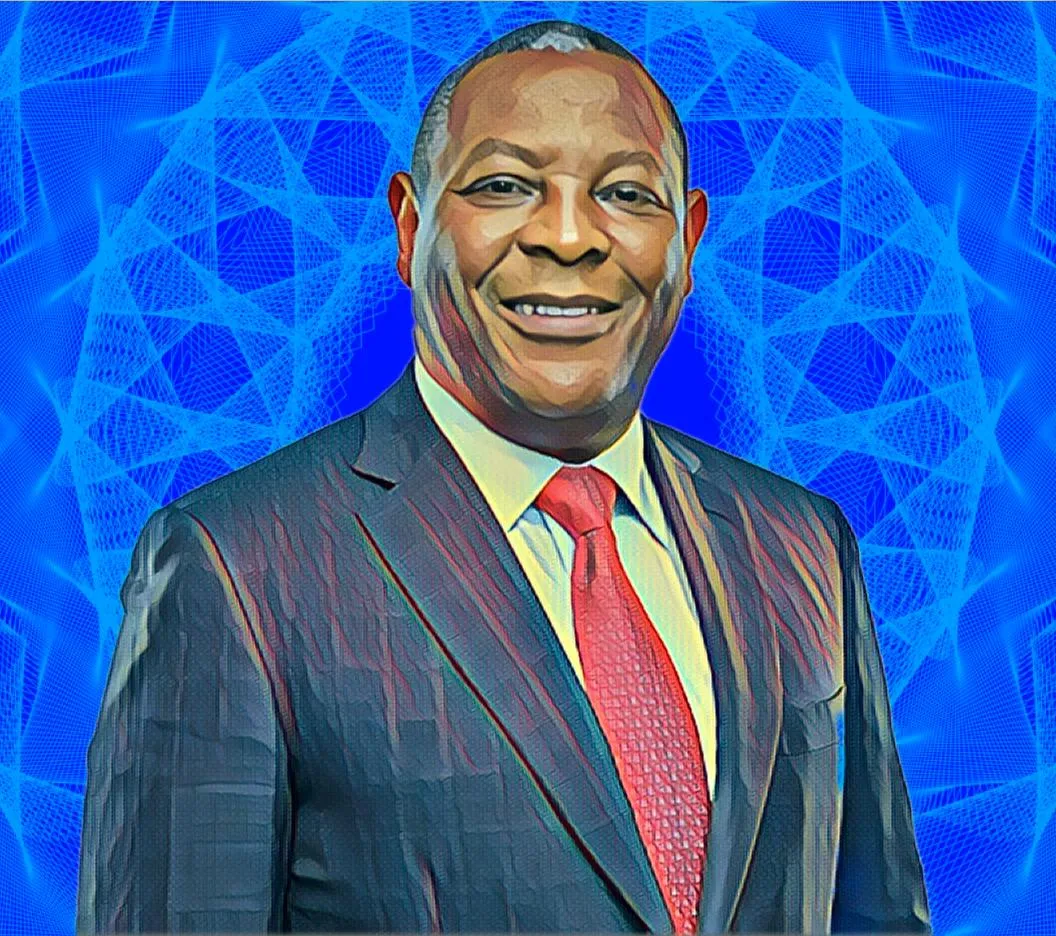

Equity Group Holdings, a Nairobi-based financial services group managed by Kenyan multimillionaire businessman James Mwangi, has launched a private-sector-focused stimulus package to expedite economic recovery and resilience in East and Central Africa.

The stimulus, which will be focused on the food and agricultural, manufacturing and logistics, trade and investment, MSMEs, and social and environmental sectors, will aid the region’s recovery from the severe health, social, humanitarian and economic effects of the COVID-19 epidemic.

According to Equity Group Managing Director and CEO James Mwangi, in order to achieve the region’s desired recovery, a total of Ksh678 billion ($6 billion) will be made accessible to 5 million MSMEs and 25 million individual borrowers over the next five years.

He went on to say that the strategy will generate 50 million jobs, 25 million directly and an equivalent number indirectly, as company ecosystems become more cohesive, linked and eventually synergize and develop.

“The recovery plan will have a special focus on youth and women, supporting them to be the primary drivers of creating and expanding opportunities in the real economy.” To ensure that no one is left behind, financing to young people will be accompanied by credit guarantee facilities to minimize default through our credit risk pricing approach, which has extended inclusive credit access to all,” he said.

Equity Group has risen to become East and Central Africa’s largest financial services group under Mwangi’s leadership. According to Brand Finance, the bank has the world’s fifth-strongest banking brand.

Its private-sector-focused stimulus plan called for funding of up to two percent of the combined GDP of the group’s six operating economies in the form of a mix of short-term overdrafts, medium-term loans and credit facilities requiring long-term project and development finance.

As of press time on March 10, shares in the main financial services organizations were trading at Ksh51.25 ($0.449). With a market capitalization of Ksh193 billion ($1.691 billion), Equity Group ranks as the second most valuable firm on the Nairobi Stock Exchange.