Table of Contents

Chari, a Moroccan B2B e-commerce and retail startup led by Sophia Alj and Ismael Belkhaya, has acquired Axa Credit, the credit branch of Axa Assurance Maroc, in a deal valued at $22 million.

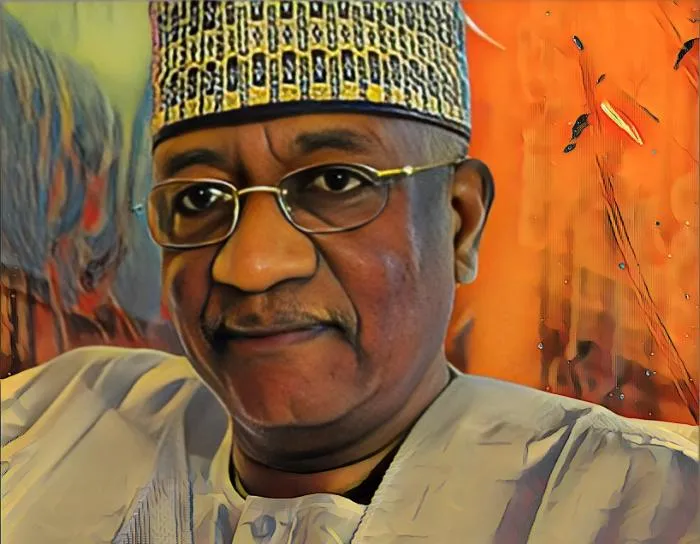

While commenting on the deal, Chari Co-Founder and CEO Ismael Belkhayat said the purchase of Axa Credit — the Moroccan credit branch of the French-based Axa Group — places Chari among the few, if not the only, startups to acquire a local branch of a worldwide bank.

“Axa Group decided to give the deal to Chari because I think they believe we are the ones able to do financial inclusion,” Belkhayat said.

The transaction, which is subject to clearance from Moroccan banking and insurance regulators, is part of Chari’s strategic development plan, which involves testing Buy Now Pay Later (BNPL) services with existing clients across Francophone Africa.

Despite having raised just $7 million so far, Axa Credit’s $22-million purchase was funded by a portion of Chari’s seed funding, a leveraged buyout (local loans from banks), and $5 million in negative working capital from its deal with FMCG manufacturers. It is also preparing to raise a significant Series-A round.

Chari is a B2B e-commerce and fintech startup co-founded in 2020 by Sophia Alj and Ismael Belkhayat. The company digitizes the heavily fragmented FMCG sector in French-speaking Africa.

The Moroccan startup concluded bridge financing at a $100-million valuation over a month ago, in accordance with its strategic ambitions to expand operations and extend its position in the fintech space.

The company is making an ambitious drive to address credit access challenges in the nation since 70 percent of the population is either unbanked, underbanked, or unable to demonstrate recurrent income. It believes it can fix these credit problems by converting store owners into loan agents.

Experts believe the transaction with Axa Group will allow Axa Insurance Morocco to refocus on its primary business, insurance, which appears to be in line with the group’s worldwide strategy, where similar restructurings have occurred in its emerging regions.

“We are thrilled to announce a cross-selling partnership between Axa Insurance Morocco and Chari. This partnership will allow Axa Insurance to keep growing on the Moroccan market and play a central role in financial inclusion,” Axa Morocco General Manager Meryem Chami said.