Table of Contents

When one thinks of family businesses, often they think of the mom-and-pop store at their nearest street corner. However, the truth is more extensive than this though.

The humble beginnings are indeed the mom-and-pop store we are all aware of. However, family businesses play a critical role internationally, especially in the context of African economies. They contribute to a significant portion of global GDP and are the second-biggest employers globally, next to governments.

So what is a family business? You may ask. Simply put, a family business is any business or company (including listed companies) that is controlled with at least 25 percent or more of the decision-making rights required by their share capital by a family. This could be the founder(s) or descendants or acquirers of the business.

In Africa, there is little to no data on family businesses, and due to this lack of reliable data, the significance, and contributions of family businesses are not fully appreciated or understood.

There are many family businesses across Africa. The continent is an entrepreneurial one, whose economic growth is in fact driven by family-owned businesses.

Yet only a small fraction of these businesses survive into the second and third generations.

PWC research on family-owned businesses in 2021 noted that 76 percent of African family businesses don’t have a succession plan in place to make sure that the business is passed down to the next generation in a planned and formalized manner.

A key issue plaguing these businesses is family dynamics. Family dynamics are a sensitive issue, with topics such as succession planning being an emotional matter. About half of first-generation African family businesses expect the next generation to become the majority shareholders in five years. But from the research data established by PWC, only 19 percent of families have a family constitution/charter, which links strongly to not having a succession plan in place.

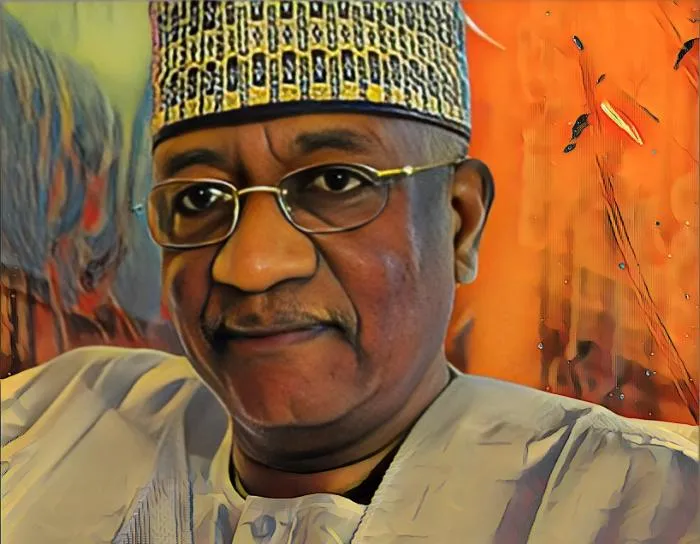

A stark example of the low survival rate of most African family businesses beyond the founder’s generation is that of the late Nigerian business mogul Moshood Kashimawo Abiola. Moshood was at one point believed to be one of the wealthiest men in Africa. He successfully built one of Nigeria’s most significant business empires consisting of an airline, a chain of newspapers, extensive real estate, fisheries, and retail. After he died in 1998, his businesses crumbled. None of them exists today. This is not a rare or surprising tale on the African continent.

In Kenya, family businesses are significant and are a source of employment for more than 60 percent of the population.

Tuskys Supermarket Chain, once a giant retailer, crumbled two decades after the death of founder Joram Kamau. At its peak, the Kenyan supermarket chain was one of the largest in the Great Lakes Area. It employed over 6,000 people in Kenya and 150 in Uganda. In 2016, Tusky’s supermarket CEO Dan Githua was ejected from his office unceremoniously by the heirs to Tusky’s empire. The grandchildren reportedly stormed the CEO’s office and ordered him to leave the premises, and he was recalled two months later. Some of the reasons that contributed to the collapse of the multi-billion supermarket, which had several branches in major towns, include sibling rivalry, internal fraud, aggressive debt-fuelled expansion, and fierce competition. By August 2020, it had accumulated debt worth $55 million owed to suppliers and creditors. Despite entering into a $417-million agreement with a Mauritius firm to ward off financial constraints, the closure of its last branch in Nakuru proved to be the final nail on its coffin.

Zimbabwe has had a chain of prolific transport companies and families leading them. Just looking at one such successful one. Shoeshine Buses, which was owned and founded by Mr. P. Hall. When he died, the company had 62 buses. After two years, the number had gone down to 55, and in 2009 no buses or company existed. This data is extracted from research done into succession planning in the commuter transport sector in Zimbabwe by Sikomwe S.

How can African families start increasing the success rate of their family business wealth transfer to truly create a multigenerational wealth transitional journey? The families may want to engage consultants that help them navigate governance and succession. Particularly focusing on “The Five Capitals of Family Wealth.” These capitals I learned from my friend and mentor Jay Hughes and his extensive work successfully helping families of wealth.

These five capitals look like this:

1. Human Capital – The families need to explore and appreciate all the people who make up their family group. Contrary to just the skills they may bring to the proverbial table, maintenance of human capital is centered on ensuring the family members are healthy, physically, mentally, and emotionally. You can’t have a well-functioning family if you don’t have healthy human beings in good relationships with each other. Good functioning relationships do not mean always getting along, but they do mean being able to work together for the greater common goal.

2. Intellectual Capital – What does every family member bring to the table? Intellectual capital is the unique knowledge every family member has. Not just school-based education or knowledge, but experiential knowledge that can benefit other family members. Experiential knowledge includes both positive experiences, like tips on travelling to different global destinations, and difficult ones like surviving a divorce or a period of addiction. Archiving these in some fashion will create a rich treasure trove of insights and resources for current and future family members. Shame is sometimes a detractor when amassing this knowledge. Family members may feel embarrassed to share some of their socially unacceptable or morally sensitive experiences. So how these are captured may take the skill and tact a professional will know how to bring. Most importantly, healthy intellectual capital is based on seeing and respecting the uniqueness of each individual family member.

3. Social Capital – Many families worry about what perception is out there about them and their wealth, business, and personal choices. Social capital is about how the family connects to the larger world. When the family name comes up, what do members of the community say? When the name of a family business is spoken, what are the responses? Social capital is often built around philanthropy and support for important causes, but it doesn’t have to be. It can be as simple as generously hosting gatherings at the family home for the neighbors or small community-enhancing donations. A company is never too small or too big to consider things like ESG and ethical practices.

4. Spiritual Capital – When it comes to this capital, its name implies greater spiritual well-being. This capital defines what it means to be a member of the family. It addresses what the family stands for; its values and beliefs. It can be based on a religious tradition or on a set of timeless virtues. These include compassion, love, connection, personal growth, and respect, to name a few. A family can create a statement about how they will be with and treat each other, their extended family, their friends, and their community as a way of defining their spiritual capital.

5. Financial Capital – Intentionally listed last, the financial capital or resources of a family should be preserved and deployed to support the other four capitals. If the family is healthy in each of the other four capitals, they will be great owners of financial wealth and have a plan to develop future wealth stewards. Skills like hiring an advisor, being strategic in wealth planning, talking about financial assets, and avoiding entitlement will be part of the family’s intellectual capital and culture.

Thus, the answer to what to do to build financial stability is simple. How to implement it needs the right team who are knowledgeable. No amount of financial advice or legal advice can help secure the future of the family wealth if the work on the capital is not done. Seventy-five percent of African family businesses have some form of governance policy in place but still lag their global peers. Only 41 percent have a last will/testament in place, and various other policies are also being neglected and should be getting more attention. Natural governance may work in the first and second generations, but as the global trend has seen, when the family gets to the third generation, there is a need to formalize governance to accommodate the larger family. Governance, when done intentionally, can become the strongest and most vital foundation to wealth building.

Tsitsi Mutendi is a co-founder of African Family Firms, an organization that aims to facilitate the continuity of African family businesses across generations. She is also the lead consultant at Nhaka Legacy Planning and the host of the Enterprising Families Podcast.