Table of Contents

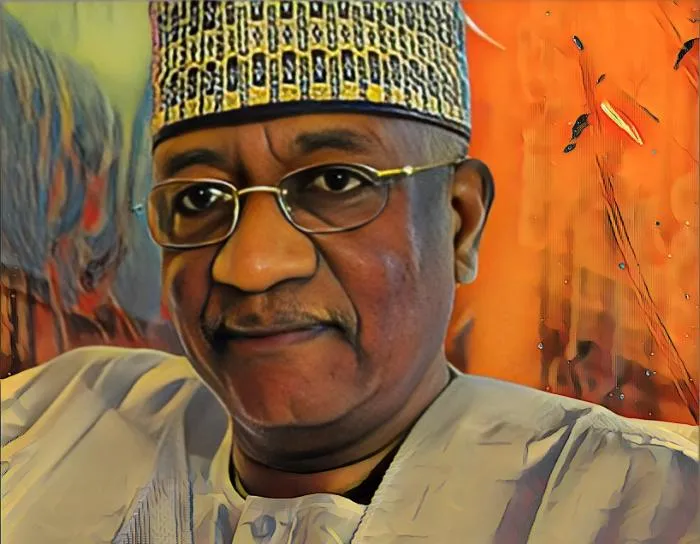

A new wave of investor buying interest on the Bienvenue sur Bourse de Tunis (Tunis Stock Exchange) has seen Tunisian automobile tycoon Moncef Mzabi record impressive gains from his shareholding in Automobile Reseau Tunisien and Services SA (ARTES).

ARTES is a Tunisia-based automobile retailer.

Mzabi, who started ARTES with his brothers Mzoughi and Sadok following the acquisition of Renault Tunisie in 1997, holds a substantial 24.8-percent stake in the company.

Data gathered by Billionaires.Africa revealed that the market value of his stake has risen by TND4.08 million ($1.43 million) in the past 21 days.

As of press time, Jan. 18, shares in ARTES on the local bourse were trading at TND6.43 ($2.247), 1.08-percent lower than their opening price on the local bourse this morning.

Since Dec. 27, 2021, the company’s share price has increased from TND6 ($2.1) to TND6.43 ($2.247) as of the time of the drafting of this report, as investors sustained buying interest in the automobile retailer ahead of its 2021 financial statement.

In the past 21 days, the price surge in ARTES shares has accrued a 7.17-percent gain for shareholders. This pushed the market capitalization above the TND245.9-million ($85.9 million) mark.

As a result of the price bump, the market value of Mzabi’s 24.8-percent stake has expanded from TND56.92 million ($19.89 million) on Dec. 27, 2021 to TND61 million ($21.31 million) as of the time of the drafting of this report.

The $1.43-million value surge in his shareholding in the past 21 days cements his position as one of the wealthiest investors on the Tunis Stock Exchange.

In 2021, Mzabi saw his equity position surge by TND19.73 million ($6.9 million) thanks to a $50.7-percent increase in the company’s shares for the year.