Table of Contents

Egypt-based dairy, juice and cooking product manufacturer, Juhayna Food Industries, has reported higher consolidated earnings in the first nine months of 2021, as its consolidated net profit soared above EGP490 million ($31 million).

Figures contained in the company’s nine-month financial statement for 2021 revealed that in consolidated terms, its profits surged by 27.7 percent from EGP384 million ($24.47 million) in 2020 to EGP490 million ($31.22 million) in 2021.

The strong growth in its earnings in the review period can be linked to a substantial hike in its revenue, spurred by strong demand growth and improved pricing thanks to the diversity of its product portfolio, which includes products.

Juhayna Food Industries is a leading company specializing in producing, processing and packaging dairy, juice and cooking products.

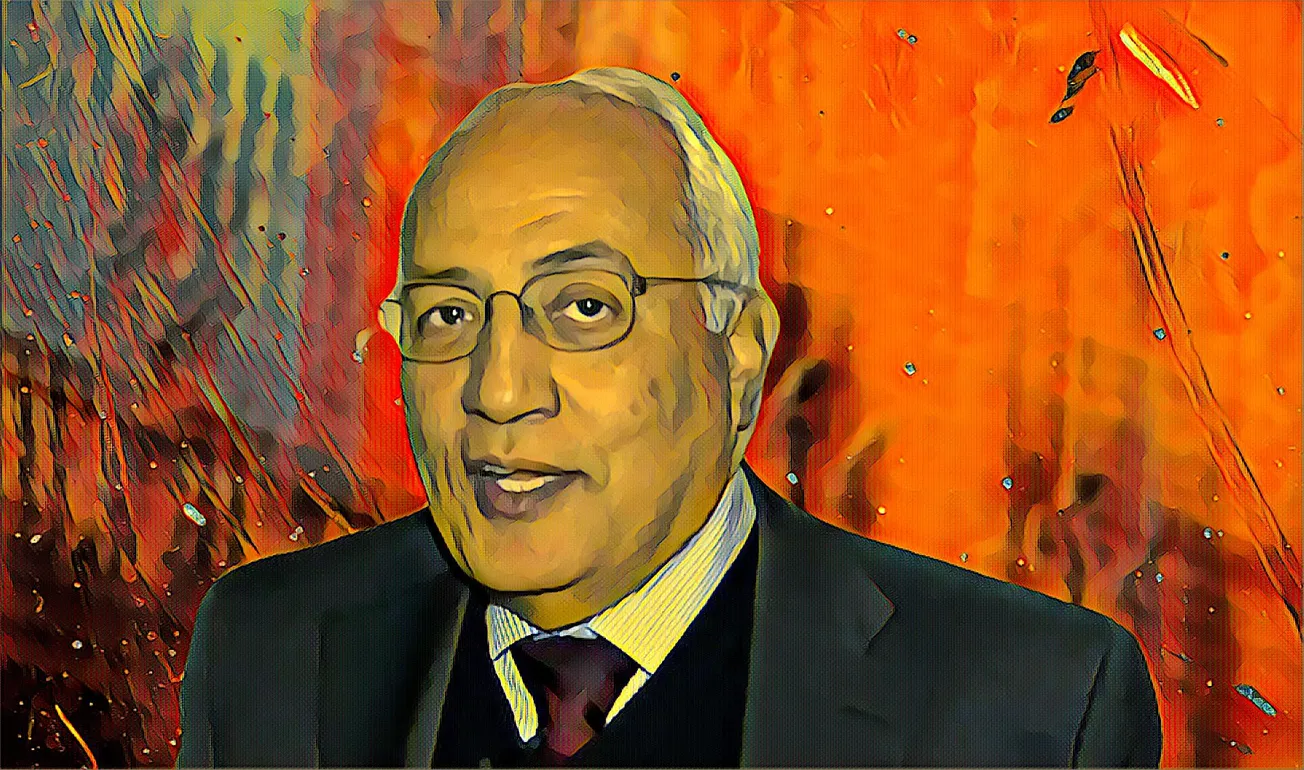

The company operates in five business segments in the food-processing industry and agro-allied segment under Safwan Thabet, the Egyptian multimillionaire businessman who founded Juhayna in 1983.

In addition to the growth in revenue in the first nine months of 2021 from EGP5.62 billion ($358.12 million) in 2020 to EGP6.52 billion ($415.47 million), its earnings benefitted immensely from operational efficiency initiatives and operational leverage as cost and credit risk were minimized.

As a result of its strong performance in 2021 and its robust results in 2020, the board of Juhayna Food industries approved a cash dividend distribution of EGP0.20 ($0.01274) per share to shareholders for the 2020 financial period.

In 2020, despite the impact of the COVID-19 pandemic on its operating environment, Juhayna reported a net profit of EGP428.5 million ($27.3 million), 30.3-percent higher than the EGP328.8 million ($21 million) that it recorded in 2019.

As of press time, Dec. 4, shares in the Egypt-based consumer goods company were worth EGP6.99 ($0.4454), 145-basis points higher than their opening price for the week.