Table of Contents

The largest supermarket chain in Botswana, Choppies Enterprises Limited, has posted its first profit since 2016 as earnings during its 2021 financial year surged above the BWP59-million ($5 million) mark.

Figures contained in the holding’s financial statement revealed that its bottomline improved by 116.1 percent from the loss of BWP370.6 million ($32.4 million) that was reported last year to BWP59.6 million ($5.2 million) during the period under review.

Despite a single-digit decrease in revenue from BWP5.42 billion ($473.4 million) to BWP5.33 billion ($465.5 million) in the period, Choppies’ operating profit rose from BWP208 million ($18.2 million) to BWP226.2 million ($19.8 million).

The increase in operating profit can be linked to cost-optimization strategies that resulted in the reduction of employee costs, lower levels of foreign exchange losses and ultimately a 7.2-percent reduction in operating profit during the period.

Choppies Enterprises Limited is a Botswana-based investment holding company operating in the retail sector in Southern Africa.

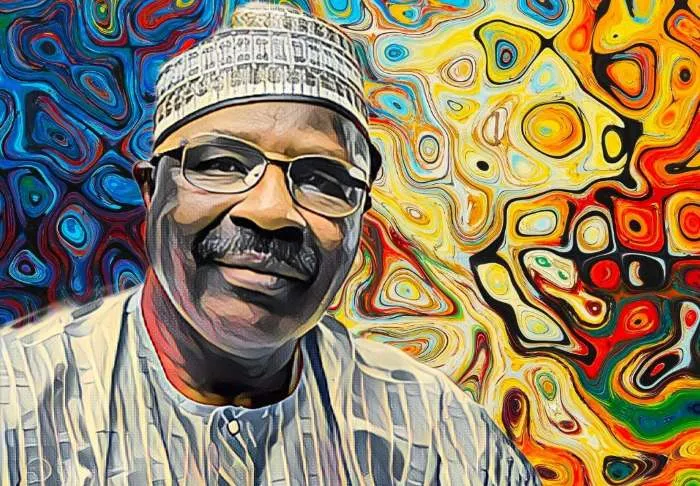

The group operates as a leading player in the food and general merchandise retail segments under the leadership of Ramachandran Ottapathu, who co-founded the retailing giant with Farouk Ismail in 1986.

Over the years, Choppies has grown into one of the largest retailers in Southern Africa, with 154 stores and eight distribution centers across the region.

Analysts believe the holding would have posted a profit in 2020, but last year’s BWP469.6 million ($41 million) in losses relating from the divestiture of its South Africa operations sold in 2020 reduced its BWP99 million ($8.6 million) in profit to a loss of BWP370.6 million ($32.4 million).

As a result of its resilient financial performance, the holding’s negative equity fell from BWP467.1 million ($40.8 million) as of June 2020 to BWP448.4 million ($39.2 million) as of June 2021.

Meanwhile, the value of its assets decreased from BWP1.84 billion ($161 million) to BWP1.7 billion ($148.5 million) and total liabilities narrowed from BWP2.31 billion ($202 million) to BWP2.15 billion ($187.8 million).

As of press time, Oct. 7, shares in the Botswana-based retailer were worth BWP0.6 ($0.0524) per share, giving the company a BWP782-million ($68.3 million) market capitalization as of the time of writing.

The market value of Ottapathu’s stake in the group is valued at BWP189.5 million ($16.6 million).

Skip to content

Skip to content