Table of Contents

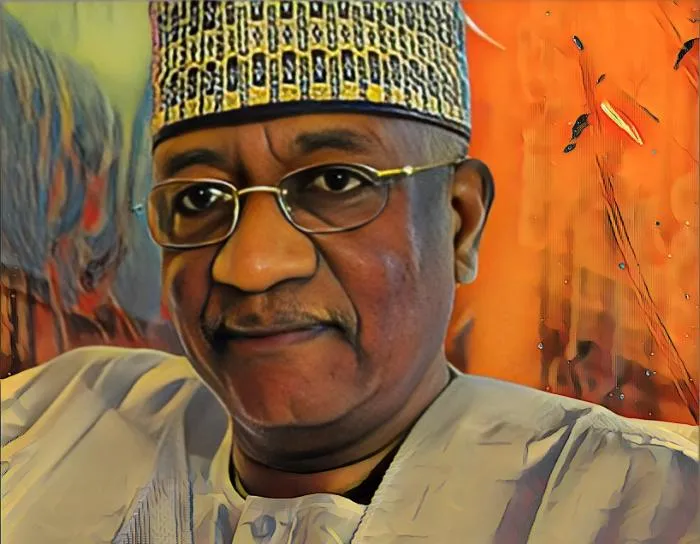

Tunisian banker and multimillionaire businessman Mehdi Tamarziste has suffered TND11.5 million ($4.1 million) in losses in more than six months from his stake in the Tunisia-based Banking Union for Commerce and Industry (UBCI).

UBCI is a commercial bank based in Tunis, Tunisia’s largest city and capital. It operates as a subsidiary of BNP Paribas, a French international banking group ranked as the largest bank in Europe and the seventh-largest globally by total assets.

In the first nine months of its 2021 financial year, the bank recorded a 9.01-percent increase in its net banking income to TND193.65 million ($68.8 million), according to the latest quarterly indicators.

As of press time, Nov. 1, shares in the Tunisia-based lender were trading at TND19.54 ($6.92). This is 18.6-percent lower than their share price of TND24 ($8.5) on April 21.

The 18.6-percent decline in the bank’s share price can be attributed to a sell-off in the bank’s shares as investors offload stakes in the lender after the share price surged to record highs on April 21.

As a result of the decline in stock price, Tamarziste, who holds a significant 12.9-percent stake in UBCI, suffered a multimillion-dollar loss in the market value of his stake.

Research conducted by Billionaires.Africa revealed that the value of his stake has fallen from TND62.14 million ($22 million) on April 21 to TND50.6 million ($17.9 million) as of the time of writing.

This led to a TND11.5-million ($4.1 million) loss for the businessman in more than six months.

Aside from his governance role as a chairman in UBCI, Tamarziste is managing director at Meninx Holding, a family-owned investment company managing the investment portfolio of the Tamarziste family.