Table of Contents

Leading East African cement company East African Portland Cement (EAPC) has rebounded from significant losses last year, as earnings at the close of its 2021 financial year benefitted from a Ksh5.78-billion ($52 million) fair value gain on investment properties.

Figures contained in the group’s audited financial statement for its 2021 financial year, which ended on June 30, revealed that the company’s profit surged by 168 percent to Ksh1.9 billion ($17 million), compared to the loss of Ksh2.8 billion ($24.9 million) that it reported last year.

Meanwhile, its bottomline improved from a comprehensive loss of Ksh2.77 billion ($24.9 million) in 2020 to a comprehensive income of Ksh2.26 billion ($20.29 million) in 2021, boosted by gains in the value of its investment properties and other comprehensive income of Ksh371.4 million ($3.33 million).

EAPC is a Kenya-based construction company specializing in the manufacturing and sales of cement and cement-related products.

It has been Kenya’s leading cement manufacturer since 1933. It currently ranks third in terms of market share behind Bamburi Cement and Mombasa Cement Limited.

The company reported a total of Ksh2.8 billion ($25.2 million) in revenue at the end of its current financial year, up by 12 percent from the Ksh2.5 billion ($22.5 million) that it reported last year.

With the exception of the value gain on investment properties and other comprehensive income, EAPC posted an operating loss of Ksh3.21 billion ($28.9 million) impacted by a direct cost of Ksh3.6 billion and operating expenses of Ksh2.5 billion ($22.5 million).

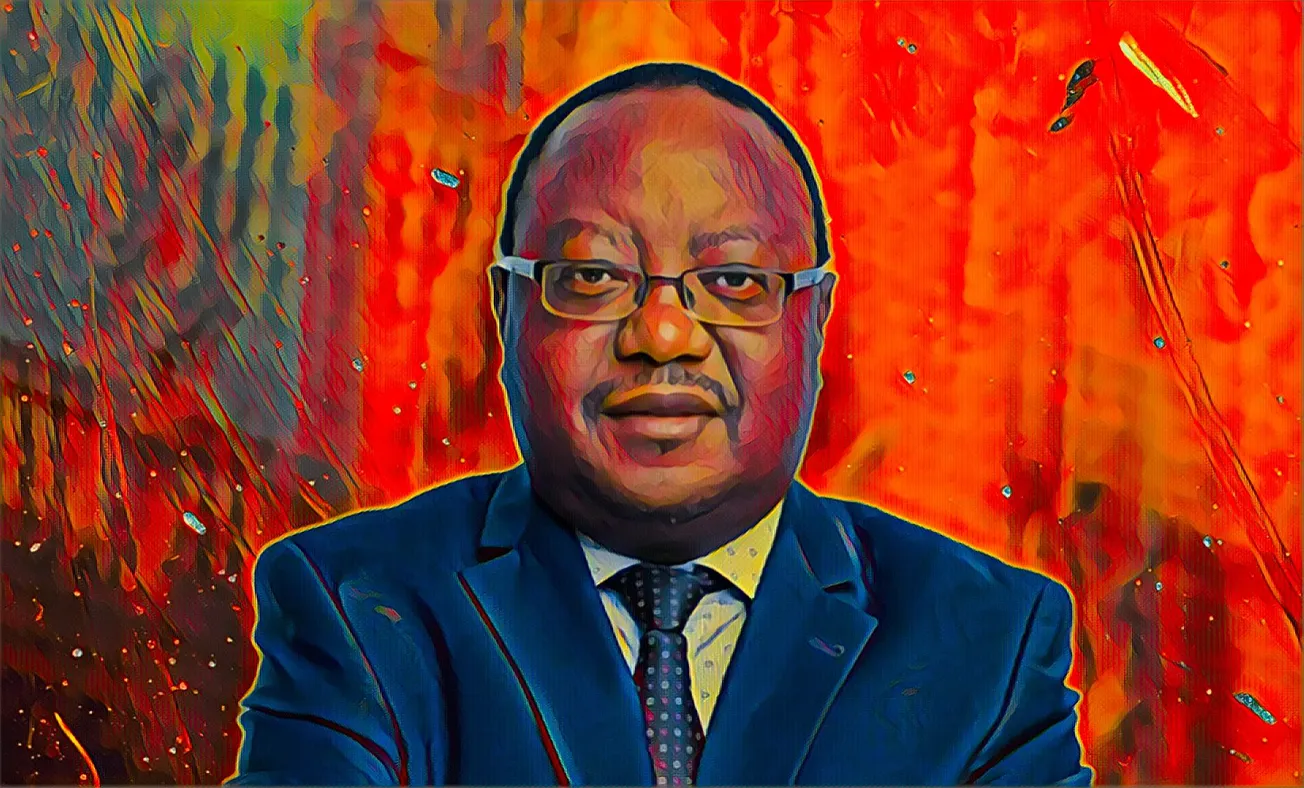

Edwin Kinyua, the chairman of the Kenya-based cement manufacturer, disclosed that the year was marked by resilience. This prompted its revenue to increase by Ksh288 million ($2.6 million) in the face of declining retail prices.

He explained that the gross loss position improved marginally to Ksh821 million ($7.4 million) over the year, with the majority of the gains the result of reduced factory staff costs offset by a deterioration in plant integrity.

He concluded that, with the company’s restored plant capacity in focus, the cement company will be well-positioned to mine from its brand equity by consistently pushing products in the market.

As of press time, Nov. 1, shares in EAPC were trading at Ksh8.10 ($0.0728) per share, 3.85-percent higher than its opening price this morning, as investors reacted to the annual report.