Table of Contents

Nigeria-based financial holding, Stanbic IBTC Holdings, has reported a 39.6-percent decline in profit for the first nine months of its 2021 financial year, which ended on Sept. 30.

Stanbic IBTC Holdings is a Nigeria-based financial services holding with subsidiaries in banking, stock brokerage, investment advisory, asset management, ventures, investor services, pension management, trustees and life insurance.

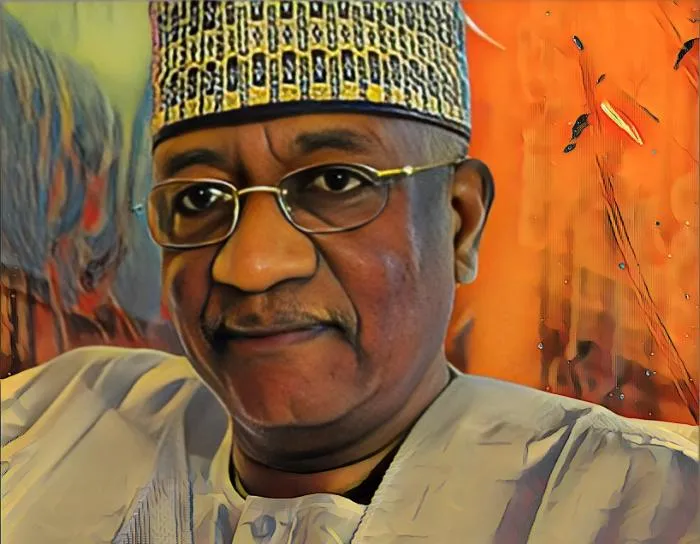

The company operates as a member of Standard Bank Group, a financial services giant based in South Africa under the leadership of Demola Sogunle, who was appointed CEO on July 1, 2020.

Figures contained in the group’s quarterly filings revealed that its profit for the nine-month period fell by nearly 40 percent from N66.2 billion ($161.1 million) in 2020 to N39.9 billion ($97.1 million) in 2021.

Financial performance for the period was significantly impacted by a slump in trading revenue, driven by a decline in income generated from fixed-income assets and foreign currency trading activities during the period under review.

This pressured gross earnings downward by 20 percent from N183.3 million ($446.1 million) in 2020 to N146.6 million ($356.8 million) in 2021.

In addition to the external and systemic risks that impacted Stanbic’s gross earnings, internal factors including an increase in operating expenses pressured the group’s earnings below the N40-billion ($97.3 million) mark, from N66.2 billion ($161.1 million) a year ago.

Stanbic also generated lower cash flows from its operations in the period, as net cash flows from operating activities declined from N240.1 billion ($584.3 million) in 2020 to N46.8 billion ($114 million) in the nine-month period under review.

Despite these negative factors, the group was able to grow its total asset value from N2.49 trillion ($6.1 billion) at the start of the year to N2.75 trillion ($6.7 billion) as of Sept. 30.

However, its liabilities grew faster from N2.1 trillion ($5.1 billion) at the beginning of the year to N2.39 trillion ($5.9 billion) as of the time of writing. This eroded the value of equity attributable to shareholders by 5.1 percent.