Table of Contents

Absa Bank Kenya has put up for auction more than 40 vehicles purchased by the bankrupt Italian firm CMC di Ravenna over debts and other financial obligations linked to the firm, amounting to Ksh585 million ($5.28 million).

Formerly Barclays Bank Kenya Limited, Absa Bank Kenya is a commercial bank operating as the Kenyan subsidiary of the South Africa-based Absa Group Limited.

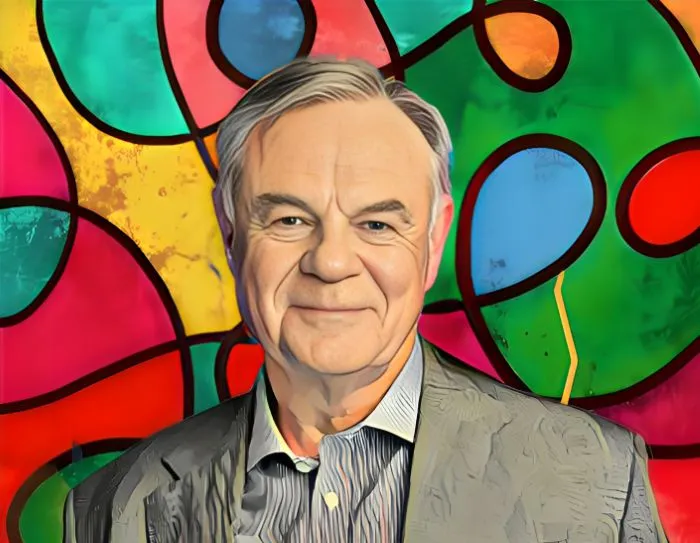

The decision made by the Jeremy Awori-led bank to auction the seized vehicles and equipment follows a consent letter signed before Kenyan Justice David Majanja by Absa and the Italian firm after it failed to fulfil its financial obligations to the Kenyan lender, a recent report revealed.

Earlier, CMC di Ravenna was contracted by Kenya’s Central Rift Valley Water Development Agency (CRWDA) to construct the multimillion-dollar Itare dam in Nakuru County.

The Italian firm put construction on hold in November 2018. It left the site after going bankrupt and filed for insolvency in Italy to rescue its operations and avoid liquidation.

Prior to handing over the dam project to the CRWDA, CMC di Ravenna had accumulated debts and tax obligations running into millions of dollars.

Absa said the Italian company approached it in 2017 and 2018 for various financial facilities.

In total, Absa’s lawyer Kamau Karori said it loaned CMC di Ravenna Ksh585 million ($5.28 million) to purchase 98 vehicles and equipment for the dam project.

The sale will set the company on course to recover the loan. If there is a shortfall, the remaining amount will be included in a bankruptcy plan under administration in Italy and recognized in Nairobi.

The recovery of the Ksh585-million ($5.28 million) loan will set the bank on course to reduce the loans in its books below or around the KSh201-billion ($1.81 billion) mark.

As of June 30, Absa Bank Kenya had Ksh201.95 billion ($1.82 billion) in loans and advances with customers. This is lower than the Ksh208.90 billion ($1.89 billion) that it reported at the start of the year.

Awori, the bank’s managing director, received $850,800 (KSh93.20 million) in compensation in 2020.