Table of Contents

TymeBank has launched its Philippine subsidiary, GOTyme. The move comes after the bank received a digital banking license from the Philippines Central Bank.

TymeBank is a South Africa-based digital bank linked to billionaire businessman and CAF President Patrice Motsepe. The bank is majority-owned by the mining tycoon.

The bank has no physical branches, as its core banking technology platform is hosted in the Cloud.

Commenting on the launch, Mostepe said: “We are proud of TymeBank’s South African roots, and we look forward to sharing our knowledge with our international partners at GOtyme in the Philippines and replicating TymeBank’s success on the global stage.”

In February, the fintech company raised $110 million in private capital to expand in South Africa and the Philippines in partnership with JG Summit Holdings Incorporated.

The funding aided the bank in expanding its range of products, growing its lending portfolio locally and funding its offshore expansion opportunities.

JG Summit Holdings is a Philippine conglomerate privately owned by the billionaire Gokongwei family. The partnership enabled the bank to apply for a local digital bank license to expand into the Asian country.

As of February 2019, TymeBank reached the 3o-million customer mark in South Africa and, by July 2021, it grew its customer base to 3.5 million active customers. JG Summit Holdings hopes to replicate this success in the Philippines.

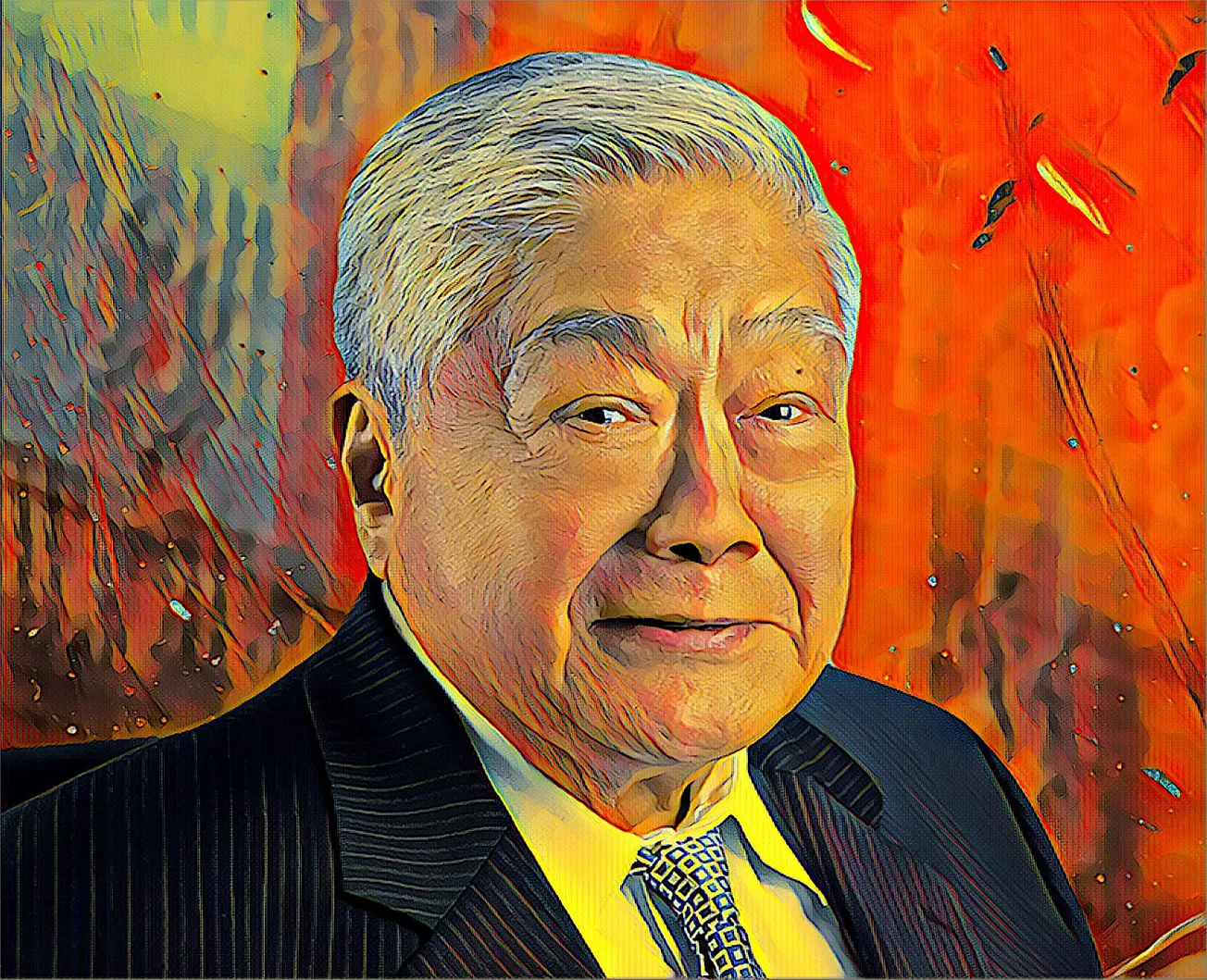

“Together with our South African partners, GOtyme will bring about opportunities for improved financial inclusion for Filipinos,” JG Summit Holdings President and CEO Lance Gokongwei said.

Gokongwei is the only son of the late John Gokongwei, Jr., who founded the company.

“We see our model of digital banking, with onboarding and education in retail networks and a well-designed app for transacting, as the best way to provide greater financial empowerment to our customers,” he said.