Table of Contents

The leading pan-African fintech company Cellulant Corporation has announced the acquisition of a payment services provider (PSP) license in Ghana.

This comes barely a month after the Bank of Tanzania (BOT) issued it a license to operate in Tanzania after satisfying all regulatory requirements.

The acquisition will see Ghana join a league of more than 13 African countries that have opened their markets for the fintech company to operate.

The African review reported that the announcement followed the Central Bank of Ghana’s issuance of the PSP license to the Nairobi-based fintech company.

This latest acquisition is a requirement under Ghana’s Payment Services Act of 2019, which mandates that the Bank of Ghana license all financial technology or digital payments companies before operating in the country.

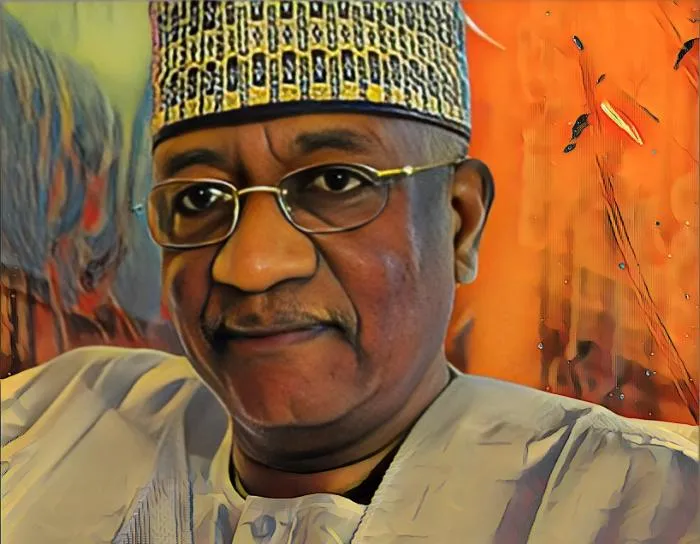

Cellulant Corporation was founded in 2014 by Ken Njoroge, a Kenyan technopreneur and his Nigerian partner Bolaji Akinboro.

The fintech company provides a payment solution that serves consumers, retailers, merchants, banks, mobile network operators, governments and international development partners.

It will launch its widely accepted Tingg platform in Ghana to allow individuals and businesses to digitize payments and collect and disburse payments to customers.

“Being licensed by the Bank of Ghana means a lot to the growth of our industry and opens doors to increased security and confidence in digital payments systems,” Cellulant Country Manager Eric Kortey said. “Cellulant’s digital payments platform is allowing every Ghanaian to pay for their goods and services through any payment channel of their choice.”

While Cellulant aims to roll out a digital payments solution for businesses in the West African country, the fintech will also aggregate merchant services, process financial services, acquire merchants, deploy POS systems and aggregate payments for banks, institutions and the general public.

The fintech company currently serves more than 120 banks, including Barclays, Standard Chartered, Ecobank and Standard Bank.

It also serves over 40 mobile network operators, including Safaricom, Econet and MTN, and 600 local and global merchants, including Opera, Transfertoo, Dangote Rice and Kenya Airways.