Table of Contents

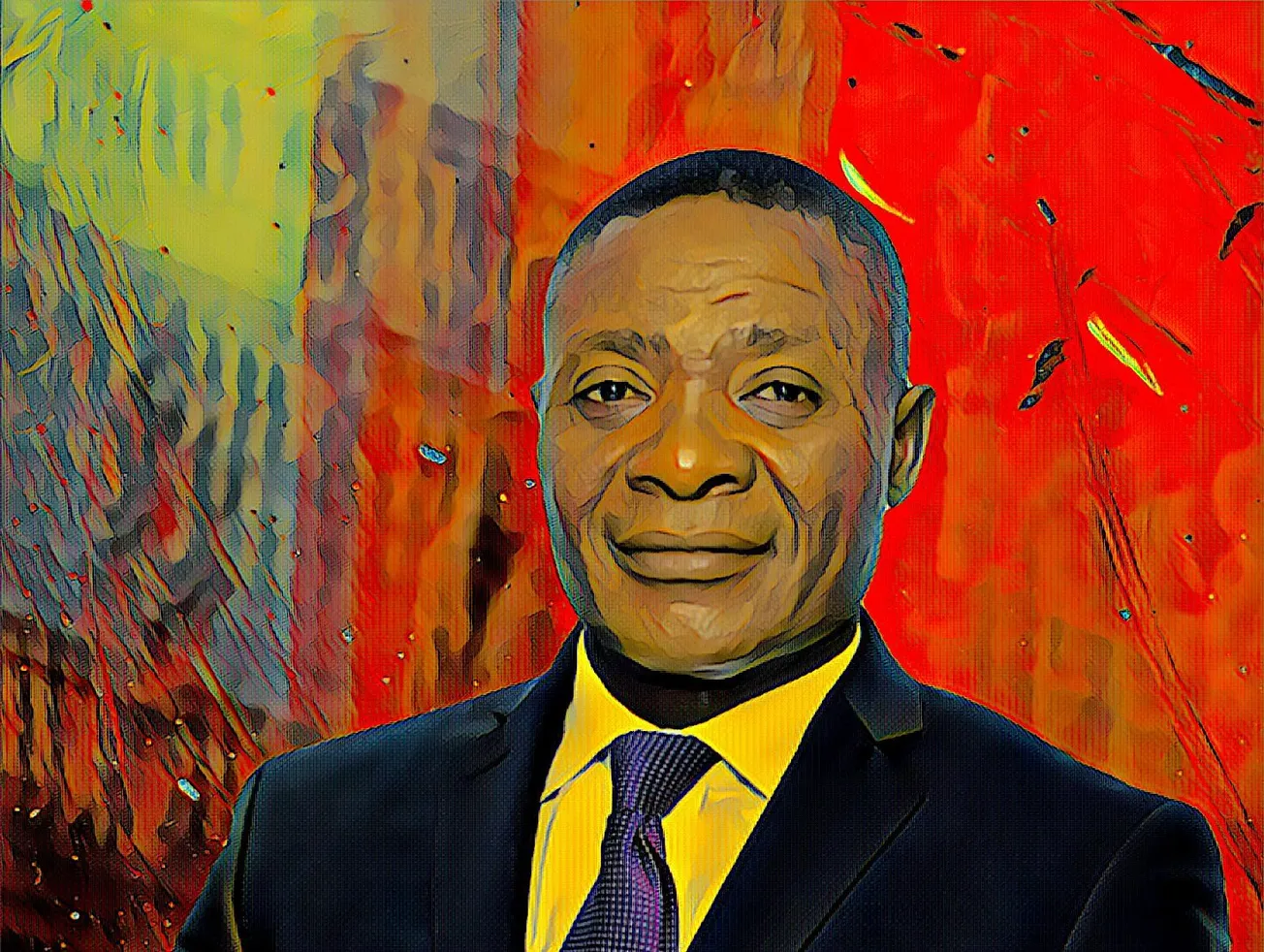

Ghanaian businessman and serial investor Daniel Ofori has recorded a gain of GH₵45.67 million ($2.50 million) from his equity stake in Societe Generale Ghana.

The multimillion-dollar gain came on the back of a nearly 50-percent rise in the shares of the Ghana-based lender. The increase comes as investors and traders re-price equities on the Ghana Stock Exchange, leading to price appreciation and gains for shareholders of listed entities after a poor economic performance across the board in 2020.

The Ghanaian bourse emerged as the best-performing stock exchange on the African continent after it returned a nearly 36-percent growth in dollar terms for investors in the first half of 2021.

MTN Ghana led the pack as the best performing stock with a first-half return of 87 percent for shareholders, followed by Ghana Breweries, Societe Generale and GCB Bank.

Ofori, who is known for his multiple investments in companies in the financial services industry, is one of the many investors who have seen the value of their stakes in companies grow by double-digits since the start of the year.

The multimillionaire owns stakes in Societe Generale and Ghana Commercial Bank (GCB), one of the best-performing stocks on the Ghana Stock Exchange this year.

Aside from his 6.78-percent equity stake in Societe Generale Ghana and 7.49-percent stake in GCB, the multimillionaire holds a total 2.45-percent interest in the Ghana-based CAL Bank.

Ghana’s fourth-largest bank, Societe Generale Ghana is the Accra-based subsidiary of the French multinational investment bank Societe Generale, headquartered in Paris, France.

As of press time 5:45 PM (UTC), July 26, shares in the lender were worth ₵0.95 ($0.1591) per share, 48-percent higher than its opening price of ₵0.64 ($0.1072) per share for the year.

The lender’s stock ranks third on the Ghana bourse in terms of year-to-date performance. It is also the seventh-most traded stock on the local exchange over the past three months.

The recent rise in the shares of the bank has caused the market value of Ofori’s 6.78-percent stake in Societe Generale Ghana to gain GH₵45.67 million ($2.50 million) in 207 days.

Research by Billionaires.Africa revealed that the value of his stake has increased from GH₵30.77 million ($5.15 million) on Dec. 31 to GH₵45.67 million ($7.65 million) as of the drafting of this report.